India`s Life Insurance Sector Logs Strong November Surge Led by Private Insurers and LIC: PL Capital

PL Capital, one of India’s most trusted financial services organizations, in its latest report on Life Insurance cited that India’s life insurance industry recorded a robust performance in November 2025, signalling renewed momentum across both private insurers and the Life Insurance Corporation of India (LIC). India’s life insurance industry recorded a robust performance in November 2025, signalling renewed momentum across both private insurers and the Life Insurance Corporation of India (LIC). The month saw broad-based strength in Individual and Group Annualised Premium Equivalent (APE), supported by healthy demand patterns, an improving protection mix and a continued increase in retail participation. According to industry data, private life insurers reported a strong 27.9% year-on-year growth in Individual APE, while the overall industry expanded 26.6% during the month. LIC maintained its upward trajectory, delivering 22.9% growth in Individual APE alongside an exceptional surge in Group APE volumes.

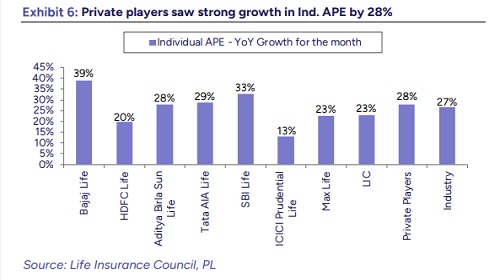

Private sector insurers—who have consistently outpaced their public sector counterpart in the Individual APE segment—demonstrated accelerated momentum in November. Within the coverage universe, SBI Life, Axis Max Life and HDFC Life emerged as the key performers, registering year-on-year growth of 32.7%, 22.6% and 19.7% respectively in Individual APE. ICICI Prudential Life reported a steady 13.1% rise, while other notable players such as Bajaj Allianz Life, Tata AIA Life and Aditya Birla Sun Life delivered impressive gains in the range of 28% to nearly 39% year-on-year. LIC, while traditionally dominant in other segments, also posted a healthy 22.9% growth in the category, underscoring the broad uptrend visible across the industry.

On a year-to-date FY26 basis, the Individual APE market has grown 7.1%, with private players continuing to lead at 11.4% growth. This recovery has been supported by sustained demand in retail protection products, stable momentum across non-participating (NPAR) offerings, and a pick-up in credit protection as loan disbursals improve. Analysts expect these drivers to remain intact, enabling the industry to maintain its growth trajectory through the remainder of the fiscal year.

The most striking development of the month came from LIC’s Group APE performance. The public sector insurer reported a remarkable 97.5% year-on-year rise in Group APE, lifting overall industry Group APE growth to 61.7% for November. In contrast, private insurers saw a marginal decline of 4.1% in the segment. However, several private companies within the covered universe, including Axis Max Life, SBI Life and ICICI Prudential Life, registered strong double-digit growth, ranging from 14.7% to 42.9%. HDFC Life, however, posted a contraction of 15.5% year-on-year in Group APE, highlighting some company-specific pressures in the segment.

LIC’s outperformance in Group APE also translated into significant gains in overall APE market share. While private players retained their majority share with 66.2% of total APE volumes, LIC’s sharp growth ensured that it continued to play a pivotal role in the market’s monthly expansion. In the Individual APE market, private sector insurers have gradually strengthened their leadership, increasing their collective market share to 71.7% in November, up from 71.1% in October. SBI Life continued to maintain the highest market share within the private category at 16.8%, followed by HDFC Life at 11.3%, Axis Max Life at 7.1% and ICICI Prudential Life at 6.1%.

New Business Premium (NBP), another critical industry indicator, also posted healthy growth in November 2025. Private insurers recorded a moderate yet stable 13.2% year-on-year increase, mirroring the 12.4% expansion seen in October. SBI Life was again the standout performer, reporting a 34.4% rise in NBP, followed by Axis Max Life’s strong 24% growth. HDFC Life delivered a mild 2.1% increase, while ICICI Prudential Life saw a sharper decline of 40.5%. LIC played a crucial role in lifting overall NBP, posting a robust 35% year-on-year growth, which pushed the industry-wide NBP growth to 23.4% for the month. On a year-to-date basis, industry NBP has risen 10.1%, indicating sustained improvement despite periodic volatility among individual players.

The strong November performance comes at a time when the industry continues to adjust to the implications of the GST exemption framework. Analysts expect value of new business (VNB) margins for FY26 to remain range-bound due to the impact of the GST disallowance, though this drag is likely to be partly offset by favourable product mix shifts and the healthy topline growth trajectory demonstrated in recent months. In particular, protection and annuity categories, along with well-positioned non-par products, are expected to contribute meaningfully to margin stability.

Based on current growth estimates and underlying financial metrics, analysts reiterated their positive outlook on key private insurers. Max Financial Services remains a preferred pick with a target price of Rs 1,925, valuing the company at 2.1x FY27 estimated price-to-embedded value (P/EV). HDFC Life also retains a Buy rating with a target price of Rs 900 at 2.6x FY27E P/EV, supported by its strong distribution capabilities, diversified product portfolio and consistent execution track record. ICICI Prudential Life and SBI Life, while exhibiting varied near-term performance, continue to be monitored closely for their strategic pivots and medium-term growth drivers.

November’s data reaffirms the resilience of India’s life insurance industry and its ability to sustain growth across multiple product categories and distribution channels. The strong showing among private insurers in Individual APE, coupled with LIC’s exceptional performance in Group APE, highlights a well-balanced environment in which both segments of the industry are contributing to expansion. As the sector navigates regulatory shifts and evolving customer preferences, the positive growth indicators from November position the industry favourably for the remainder of FY26.

Above views are of the author and not of the website kindly read disclaimer