Add Granules India Ltd For Target Rs. 660 By Choice Broking Ltd

Scaling Up for Growth

Operational Ramp-Up and CDMO Scale-Up to Drive Growth

We maintain our positive view on GRAN, supported by its strong execution capabilities and expected operational ramp-up post-Gagillapur clearance (by Jan26) alongside the scale-up at Genome Valley. While margins are likely to remain stable in FY26E, we expect improvement thereafter as remediation costs subside. Over the longer term, growth will be driven by new launches in the CDMO and peptides divisions, which are expected to contribute meaningfully from FY27 onwards

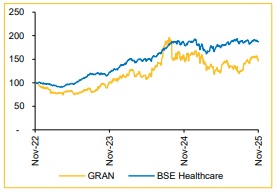

We have revised our estimates marginally upward by 1.5%/2.1% for FY26E/FY27E and continue to value the stock at 20x FY27–28E average EPS, resulting in a revised TP of INR 660 (from INR 640). However, given the recent runup in stock we revise our rating to ADD (from BUY).

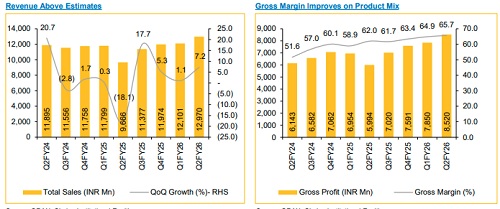

Strong All-Round Beat Led by Margin Expansion

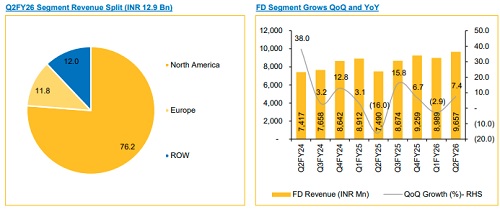

* Revenue grew 34.2% YoY / 7.2% QoQ to INR 12,970 Mn (vs. CIE estimate: INR 11,937 Mn).

* EBITDA grew 36.8% YoY / 12.8% QoQ to INR 2,782 Mn (vs. CIE estimate: INR 2,688 Mn); margin expanded 42 bps YoY / 106 bps QoQ to 21.5% (vs. CIE estimate: 20.7%).

* PAT increased 29.4% YoY / 16.0% QoQ to INR 1,306 Mn (vs. CIE estimate: INR 1,294 Mn).

FD Recovery on Track; Genome Valley to Drive Scale-up

The Finished Dosage (FD) segment is entering a strong growth phase, with Q2 already demonstrating solid momentum. Looking ahead, we expect growth to be driven by the commissioning of additional capacity at Genome Valley, which enables multi-site manufacturing and provides a second source for US formulation supplies. Further traction is anticipated in the CNS/ADHD and controlled substances portfolios. With FDA remediation expected to conclude by Q4, production resumption should support both revenue acceleration and margin recovery from FY27 onward. Overall, we expect the segment to deliver highteen growth in FY26

Peptide CDMO Expansion to Drive Next Growth Phase

The company is building a differentiated global CDMO platform focused on highvalue peptides and complex chemistry. Its current strategy is centered on attracting global innovators and emerging biotech firms. Positioned in the midto-high complexity peptide space, the company is targeting key therapeutic areas such as oncology, dermatology, and CNS. A new R&D center in Hyderabad has been commissioned to act as a bridge between Swiss innovation and Indian scale, supporting early-stage peptide development. We expect this segment to witness strong growth, led by the scale-up of GLP-1 and oncology-related products

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)