Midday Review : Lackluster trade continues on Dalal Street

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian equity benchmarks continued their lackluster trade in afternoon session, amid negative signals from other Asian markets. Sentiments got hit as domestic ratings agency Icra said India's current account deficit (CAD) will widen to 5 per cent of the GDP in the September quarter due to higher merchandise trade deficit. The trade deficit has doubled to $28.7 billion for August due to a 36.8 per cent expansion in imports and a 1.2 per cent decline in export earnings. However, downfall remain capped as foreign institutional investors were stood net buyers in the capital market on Tuesday as they purchased shares worth Rs 1,144.53 crore, as per exchange data. On the IPO front, Tamilnad Mercantile Bank’s IPO subscribed 1.79 times so far on September 7, the final day of bidding. Retail investors remained at the fore by booking their quota 4.48 times, while the portions set aside for non-institutional investors and qualified institutional investors were subscribed 1.63 times and 98 percent respectively. On the global front, all Asian markets were trading lower as the market sentiments got dampened after sluggish August trade data of China as both exports and imports grew less than expected.

The BSE Sensex is currently trading at 59099.42, down by 97.57 points or 0.16% after trading in a range of 58722.89 and 59129.35. There were 12 stocks advancing against 17 stocks declining, while 1 stock remain unchanged on the index.

The broader indices were trading in green; the BSE Mid cap index rose 0.18%, while Small cap index was up by 0.64%.

The top gaining sectoral indices on the BSE were Basic Materials up by 0.71%, FMCG up by 0.51%, Consumer Durables up by 0.48%, Telecom up by 0.47% and IT was up by 0.23%, while Auto down by 0.97%, Realty down by 0.43%, Bankex down by 0.37%, Power down by 0.29% and Metal was down by 0.27% were the top losing indices on BSE.

The top gainers on the Sensex were Ultratech Cement up by 3.45%, Bajaj Finance up by 0.95%, Nestle up by 0.83%, TCS up by 0.60% and Titan Co was up by 0.55%. On the flip side, Bharti Airtel down by 1.91%, Indusind Bank down by 1.68%, Mahindra & Mahindra down by 1.27%, HCL Tech down by 0.79% and ICICI Bank was down by 0.72% were the top losers.

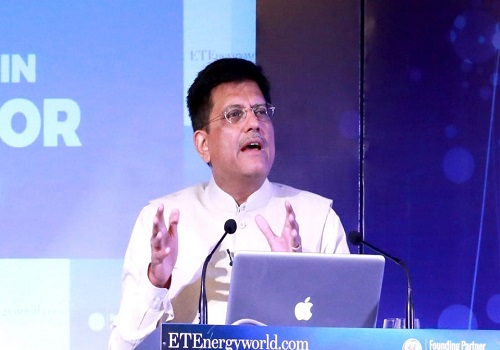

Meanwhile, Commerce and Industry Minister Piyush Goyal has said that India's goods and services exports have already crossed $675 billion in the last fiscal year and the country is now aspiring to take international trade to $2 trillion by 2030. He said ‘by 2047-2050 period, when India would be completing 100 years of Independence, we will be at least a $30 trillion economy on a business as usual scenario and possibly a $ 35-45 trillion economy if some of the aggressive plans that the government is putting together work well.’

The minister stated that India, with a GDP of $3.3 trillion, is currently the fifth largest economy in the world only behind the US, China, Japan, and Germany. A decade back, India was ranked 11th among the large economies while the UK was at the fifth position. With a 13.5 percent expansion in the June quarter, the Indian economy has overtaken the UK, which has slipped to the sixth spot.

Goyal said the government has spent the last few years laying the foundation on which the country can rapidly transform, grow its economy, improve its systems, and engage in technology. He said ‘we have recently seen some successes in terms of our international engagement growing to about $675 billion (exports of goods and services) for the first time ever last year. We are hoping to do our international trade to about $2 trillion by 2030’.

The CNX Nifty is currently trading at 17619.40, down by 36.20 points or 0.21% after trading in a range of 17484.30 and 17636.75. There were 22 stocks advancing against 28 stocks declining on the index.

The top gainers on Nifty were Shree Cement up by 6.00%, Ultratech Cement up by 3.62%, Coal India up by 1.76%, Britannia Inds up by 1.42% and Bajaj Finance up by 0.89%. On the flip side, Bajaj Auto down by 2.56%, Tata Motors down by 2.24%, Bharti Airtel down by 1.90%, Indusind Bank down by 1.75% and Apollo Hospital down by 1.62% were the top losers.

All Asian markets were trading lower; Nikkei 225 slipped 196.21 points or 0.71% to 27,430.30, Taiwan Weighted dropped 267.15 points or 1.82% to 14,410.05, KOSPI fell 33.56 points or 1.39% to 2,376.46, Shanghai Composite declined 2.02 points or 0.06% to 3,241.43, Straits Times trembled 12.15 points or 0.38% to 3,212.03, Jakarta Composite lost 41.00 points or 0.57% to 7,192.16 and Hang Seng was down by 341.98 points or 1.78% to 18,860.75.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Market is expected to open gap up and likely to witness positive move during the day- Nirmal...