No Record Found

Latest News

m.Stock trading app by Mirae Asset breaks into Top 1...

Views on LTIMindtree Ltd Q4FY24 Result by Dhruv Muda...

Rupee depreciates against US dollar on Thursday

FIIs sold equity worth Rs 25,853 crore in last seven...

Spices Board Takes Action in Response to Recall of I...

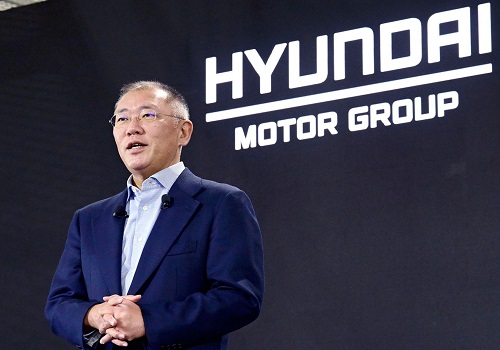

Will make India our global export hub: Hyundai Motor...

Mid-market comment by Mr Shrey Jain, Founder and CEO...

India`s Axis Bank re-appoints Amitabh Chaudhry as MD...

Former KPMG Partner, Jaideep Ghosh, joins Heartnet I...

Buy Jeera May @ 22500 SL 22200 TGT 23100-23400. NCDE...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found