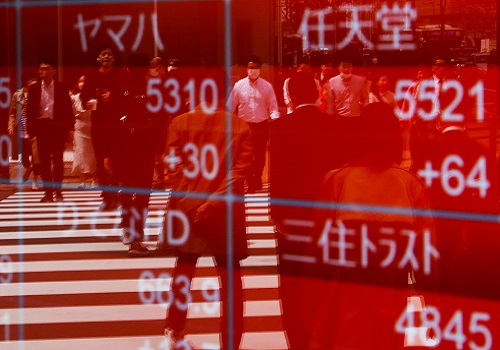

European shares rise on UK U-turn, Wall Street set to open higher

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

LONDON - European stock indexes rose on Tuesday and Wall Street was set to open higher, in a revival of risk appetite that analysts attributed to the turnaround in British fiscal policy.

Britain's new finance minister, Jeremy Hunt, on Monday scrapped Prime Minister Liz Truss's economic plan, which had sapped investor confidence in Britain in recent weeks. Relief at the U-turn prompted a rally in Europe, which lasted through U.S. and Asian trading. Wall Street's gains were also driven by better-than-expected Bank of America earnings.

The U.S. dollar index hit a 12-day low during Asian trading hours, as investors became less risk-averse. Meanwhile, the yen hit a new 32-year low versus the dollar and Japan's finance minister repeated warnings that authorities could intervene.

Market sentiment also benefited from a Financial Times report that the Bank of England was likely to delay the start of its sales of billions of pounds of government bonds. A spokesperson for the central bank said the report was "inaccurate".

At 0957 GMT, the MSCI word equity index, which tracks shares in 47 countries, was up 0.3% on the day.

MSCI's main European Index was up 0.9%, having touched its highest in 13 days. The STOXX 600 was up 0.4%, also down from a 13-day high it hit earlier in the session, while London's FTSE 100 was up 0.8%.

Wall Street futures were up as investors hoped for upbeat corporate earnings to counter the economic gloom. Nasdaq futures rose 1.7% while S&P 500 e-minis were up 1.4%.

Still, with high inflation and central bank tightening weighing on markets, analysts said the revival in sentiment could be short-lived.

"I wouldn’t say this a green light for a big rally," said Antoine Lesne, head of ETF strategy and research for EMEA at SPDR, adding that such moves would be more likely towards the end of the year if it looks like the end of the rate-hiking cycle is coming closer.

"The key positioning of investors for the moment is to remain very cautious," he said.

German investor sentiment rose slightly in October, to -59.2 from -61.9 in September, according to the ZEW economic sentiment index. But the index of current conditions fell, as respondents assess the economic situation as significantly worse than the previous month.

The British pound was down 0.7% on the day at $1.1277, having eased from Monday's 12-day high of $1.144.

The U.S. dollar index was 0.2% higher on the day, at 112.24. The dollar-yen pair was steady at around 149.05 yen per dollar.

The dollar has gained about 3% against the yen in October, with the yen dropping sharply due to the gap between U.S. rate hikes and Japan's ultra-easy monetary policy.

The euro was a touch lower at $0.9834.

The European Commission was set to propose another set of emergency measures to tackle high energy prices.

Euro zone government bond yields rose, with the benchmark German 10-year yield up 7 basis points at 2.335%.

The New Zealand dollar was up 0.5%, having jumped after higher-than-expected inflation data spurred expectations that the Reserve Bank of New Zealand would raise interest rates by 75 bps at its policy meeting next month. The Australian dollar was steady.