Motilal Oswal Value Index grows to 135 in Q4FY21, volatile trend witnessed so far

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

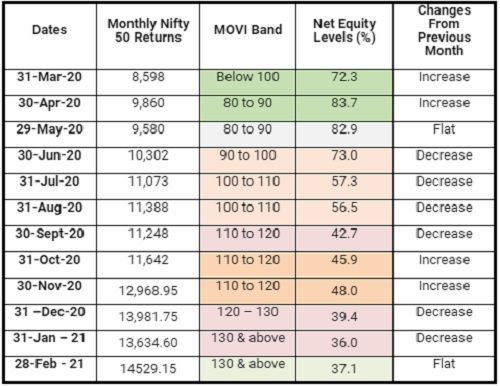

Mumbai, 22 March 2021: Motilal Oswal Value Index (MOVI) which helps gauge the equity market has witnessed a volatile trend in Q4FY21. Currently 30 day moving average is at 135 level and is suggesting that the markets are overvalued. The Index is calculated taking into account Price to Earnings, Price to Book and Dividend Yield of the Nifty 50 Index.

A low MOVI level indicates that the market valuation appears to be cheap and one may allocate a higher percentage of their investments to Equity as an asset class. A high MOVI level indicates that the market valuation appears to be expensive and that one may reduce their equity allocation.

How the three constituents help in defining MOVI levels in Motilal Oswal Dynamic Fund:

“In simple terms MOVI index is a parameter which helps to gauge the direction of the market. One should allocate less to the equities, if MOVI bands are in the higher range and similarly increase the allocation if the MOVI bands are lower. – Umang Thaker (Head of Products, MOAMC)”

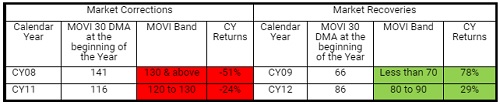

MOVI was accurate in gauging the direction of the markets, during major crisis in the past.

Even during the recent phases, when markets turned volatile, MOVI is not only accurate in sensing the market movement but also agile enough to increase / decrease equity levels in time.

The current 30 Day moving average of MOVI is near 135 levels. This falls in the highest MOVI band i.e 130 & above, indicating that markets are over heated.

Above views are of the author and not of the website kindly read disclaimer