Tata Mutual Fund Newsletter From the CIOs Desk - December 2020

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Below are Views On Tata Mutual Fund Newsletter From the CIOs Desk - December 2020

What now?

We are at that point again when markets have rallied, headline valuations of Nifty50 are above long-term averages (@19.5x FY22) but the economy is only just coming back to normalcy. Markets have been aided by earning upgrades (explained in Nov-20 newsletter) and no visible second wave despite an active (and crowded) festival season. Regular vaccine updates have helped too indicating that the first dosages would be available in months if not weeks.

In this newsletter, however we discuss three aspects of this disconnect between economy and markets across (i) profit performance, (ii) other emerging markets and (iii) broader markets.

I. The pain is elsewhere

As per various estimates of the broad indices (Nifty50/BSE100/BSE200), the operating profit (EBITDA) growth in the recent quarter (September-20) has been in the 15-20% range over previous year. This has been made possible largely by discretionary cost cuts and reasonable revenue performance. Some sectors have even gained from the pandemic (IT, Pharma, telecom) while some cyclical sectors have been helped by the recovery in China (metals). One of the themes has also been the market share gain by organised sector (represented by listed stocks) as the smaller unorganised players have struggled to maintain the same level of operations and distribution reach under funding constraints. In conclusion, the listed universe of stocks which are represented by large organised sector players in respective markets have done much better than smaller unlisted counterparts.

Having said that, the pain in the unorganised sector (while supported by government through credit guarantee schemes) will at some stage have an impact on consumption and economic growth, Covid has furthered the trend which started with demonetisation and then GST. The recent commentary from banks and other lenders to the segments however suggest pain

II. Its no different elsewhere

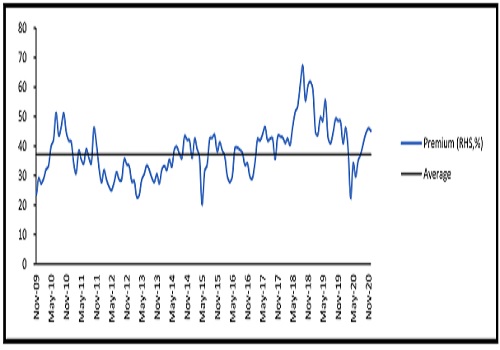

While the trend of big becoming bigger has been visible in global markets also, lower bond yields and dollar weakness has led to valuations above long term averages across other emerging markets as well. This is captured in the below chart - India's valuation premium has remained stable at 40-45% over the last 4 months indicating that the rally has been a global one.

Nifty50 valuation premium vs. emerging markets (MSCI) - %

III. Returns will spread elsewhere

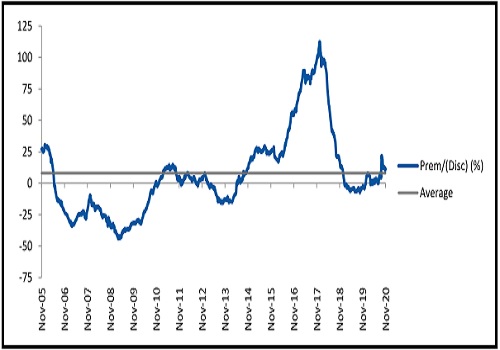

Mid and small cap segments have more to gain as (i) economy moves from cost cuts to revenue growth and (ii) new emerging themes of PLI(Production Linked Incentive Scheme) and digitisation are better represented. In addition, the headline valuations for Nifty Midcap 100 suggest that we are in an acceptable zone which can act as a platform for the broader markets to do better from hereon.

NSE Midcap vs. Nifty 50 – Premium/Discount (%)

As we look ahead, there seem to be multiple drivers of corporate profit growth emerging. What started off as cost cut driven growth in large companies is now increasingly supported by revenue growth and that could now spread to broader listed universe.

Above views are of the author and not of the website kindly read disclaimer