Tata Mutual Fund From the CIOs Desk - Balance of Macro and Micro

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Markets are finely balanced between the improving Micros (earnings, government growth push, reforms) and uncertain Macros (interest rates, crude prices). While the Nifty 50 forward valuations at 21x PER is higher than long term averages, it is adequately counterbalanced by lower interest rates (compared to long term averages), earnings upgrade cycle and strong reforms narrative. In this newsletter, we evaluate the balance between the various factors that are likely to drive the markets going forward.

I. MICRO has never looked better

Earnings upgrade cycle has continued

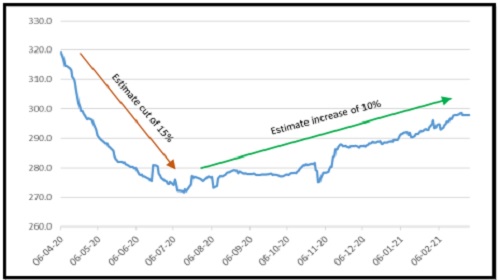

The broad corporate sector (as indicated by BSE200) has continued on the earning upgrade cycle starting with sectors which benefited from Covid (IT, Pharma), and expanding to widespread cost cuts and lower than anticipated stress in the banking system. By the time we end this financial year (FY2021), the profit estimates for next financial year (FY2022) could be very close to the estimates that prevailed before the pandemic i.e. February 2020. Infact, there are multiple sectors contributing to earnings recovery this time with equal contribution from deep domestic cyclical sectors like banks, industrials, commodities & real estate and defensive export driven sectors (IT, Pharma). The multiple drivers of profit growth and upgrades has never been so wide in the last 5-10 years providing better visibility.

Growth push and Reform measures

The push for recovering growth was very evident in the Union Budget with counter-cyclical fiscal policy; this was a big change and the impact will be felt over next 12-24 months especially if tax revenue growth continues to recover giving more room for public spending. The attempt to revive investment cycle is much needed to sustain GDP growth at a higher trajectory of 6-8%. It should be noted that economic growth had declined to 4% pre-pandemic and therefore the shift towards accommodative fiscal policy (in addition to monetary policy) is critical. The aggressive pivot on privatisation is another step in the right direction and provides options for funding the increased public spending over next 2-3 years. More could follow in the areas of asset monetisation and power distribution privatisation that could keep the reform narrative strong

The change in global supply chain dynamics post-pandemic has also provided India the opportunity; the PLI scheme has gathered momentum and related pick up in investment activity is already visible. In addition, demand revival and lower cost of funding is also leading to green shoots in private capex for example Cement, Autos, EV and Renewable.

Last but not the least, real estate demand revival has the potential to bring ancillary benefits to the connected sectors and employment apart from reducing stress on the balance of the financiers of real estate developers. Inventory absorption would eventually lead to asset creation in the real estate sector.

II. MACRO will drive the short term

Interest Rates

Demand recovery (accelerated by vaccine) will have a natural inflationary impact on the economy. How the US rates and USD behaves as a combination will be important in the short term for emerging markets including India.

1. A moderately rising US interest rates along with stable or weakening USD will be positive for emerging markets including cyclicals and value.

2. A sharp rise in US inflation/yields will have a risk-off impact on global equities and emerging markets although India could have better downside support due to earnings recovery and reform momentum.

3. A low probability scenario as of now is weakening recovery and a sharp second/third Covid wave which will lead to lower rates resulting in risk-on and outperformance of growth over value again.

Is there a bubble in US Tech?

The rally in US tech has been widespread in 2020 although it has seen correction in the first three months of this year. Any correction in the "bubble" or "retail-driven" stocks could have collateral impact on emerging market equities too. However, if accompanied by weakening USD and greater global equity allocation to EMs, it could provide some support to Indian equities.

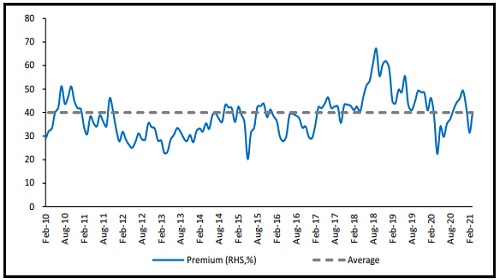

Crude prices

India's valuation premium to MSCI emerging markets has remained steady around 40% despite the rally. One of the reasons for this premium has been the positive factors outlined above. But any increase in crude prices affects India's macro variables (current account deficit, fiscal deficit) vs. other emerging markets putting India's premium valuation under threat.

Nifty 50 vs. MSCI EM premium (%)

In conclusion, as far as global rates are concerned, we believe Scenario 1 is more likely with periods of Scenario 2 induced volatility in between. But the rate movements will continue to be dynamic in 2021 depending on the timing and level of intervention from the central banks. India's earnings recovery and government's reforms narrative will however be critical in providing downside support during bouts of volatility induced by rates and/or crude prices.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer