Fixed Income Outlook - May 2021 by Tata Mutual Fund

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

WHAT HAS BEEN RBI’S OBJECTIVES AND HOW HAS IT ATTEMPTED TO ACHIEVE THE SAME

* RBI has stated its intention to ensure orderly evolution of the G-Sec curve and reduce volatility to ensure a stable rate structure. RBI Governor has repeated stated yield curve is a public good. RBI and the Government have been acting to lower bond yields.

* RBI in its monetary policy announced GSAP 1 (Government Securities Acquisition Program) to buy 1 Lakh crores of Government securities in the first quarter of the financial year. This is over and above OMO and Operation Twist which RBI will be conducting to ensure soft yield curve control.

* OMO/ OT and LTRO to stabilize the yield curve

RBI POLICY ACTIONS IN 2021

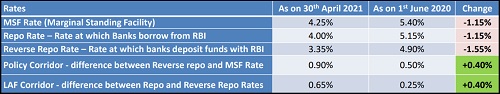

RBI cut its headline policy rates significantly to provide liquidity to banks to boost lending and encourage economic growth during the pandemic

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer