Equities see seven consecutive months of outflows; Capital Goods in the limelight By Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Key observations

The Nifty ended its three-month winning streak at 2.5% (or 347 points lower) at 13,635 in Jan’21. The month was characterized by extreme volatility, with the benchmark oscillating in a wide range (~1,150 points) and pulling back significantly from record highs. Much of the market anxiety is attributable to the caution ahead of the Union Budget. FII inflows were robust at USD2b. Domestic flows remain negative (at USD1.6b).

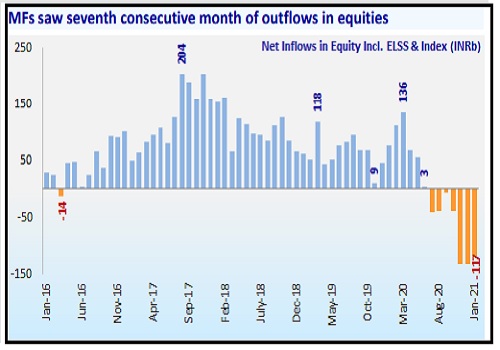

Domestic investors continue to book profit and rebalance the portfolio, leading to moderation in domestic mutual fund (MF) flows. The contribution of systematic investment plans (SIPs) declined to INR80.2b (down 4.7% MoM and 6% YoY). Equity AUM (incl. ELSS and index funds) of domestic MFs decreased 2.3% MoM to INR9.3t in Jan’21. This was on account of decline in market indices (Nifty -2.5% MoM) and equity scheme sales (down 6.2% MoM to INR254b). Similarly, redemptions declined 7.8% MoM to INR371b.

This led to net outflows of INR117b in Jan’21 (v/s INR132b in Dec’20), marking the seventh consecutive month of outflows. MF industry’s total AUM decreased 1.7% MoM (INR0.5t) to INR30.5t in Jan’21, primarily weighed by liquid funds (INR452b) and equity funds (INR216b). Notably, income funds saw an increase of INR132b MoM.

Some interesting facts

* The month saw a notable change in the sector and the stock allocation of funds. On a MoM basis, the weights of Capital Goods, Automobiles, Technology, Telecom, PSU Banks, and Cement increased, while Oil & Gas, Healthcare, Utilities, NBFCs, Consumer, and Retail weights moderated

* Capital Goods weight increased for the third consecutive month to a 10-month high of 6.3% (+50bp MoM; -90bp YoY).

* Technology continued to scale new heights as weight increased to 11.9% (+20bp MoM; +380bp YoY).

* Oil & Gas weight reached 29-month lows of 6.9% (-50bp MoM; -40bp YoY). As a result, the sector slipped into the sixth position in the allocation of mutual funds – it was in the third position in July’20.

* In terms of value increase MoM, 6 of the Top-10 stocks were from Financials and Capital Goods: Axis Bank (+INR28.7b), Larsen & Toubro (+INR15.7b), SBI Cards & Payment (+INR7.9b), CG Consumer Electrical (+INR6.4b), SBI (+INR6b), and Voltas (+INR5.7b).

* Stocks exhibited maximum decline in value MoM Reliance Industries (-INR59.1b), Kotak Mahindra Bank (-INR40.4b), Infosys (-INR29.4b), HDFC Bank (-INR27.7b), and HDFC (-INR23b).

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Above views are of the author and not of the website kindly read disclaimer

Tag News

Buy Dalmia Bharat Ltd For Target Rs.2,400 - Motilal Oswal Financial Services Ltd