The banking space has witnessed an action packed move during the last week - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

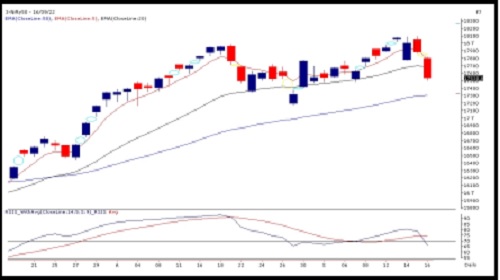

Sensex (58841) / Nifty (17531)

Friday’s session turned out to be a nightmare as after a gap down opening, we witnessed a sustained selling throughout the session to conclude the week with 1.70% cut, marginally above 17500.

Generally, we say ‘All’s well that ends well’ but this time it’s the exact opposite. We had a perfect start of the week, but the end was certainly not everyone would have wished for. The broader structure remains bullish but with Nifty closing convincingly below 17600 has dented the intermediate structure for sure. Pricewise, it resembles a ‘Head and Shoulder’ pattern on daily time frame chart, which does not augur well for the bulls. If this pattern proves its significance, we may see further correction towards 17200 – 17000 in this week. But as of now, we do not want to fall into this camp. We would rather reassess the situation in the first half of this week. As far as support is concerned, 17400 we are seeing as a key support. The moment we see Nifty sliding below it, we may see correction getting extended in the market. On the flipside, if Nifty has to find its mojo back, it needs to go beyond Friday’s high of 17820 on a closing basis. So meanwhile, any minor bounce back towards 17650 – 17750 should ideally be used to exit longs.

Nifty Bank Outlook (40777)

The banking space has witnessed an action-packed move during the last week, wherein the spectacular start of the week pared down in the last two trading sessions. However, on the weekly basis, the Bank Nifty index managed to continue its positive stature and even outperformed the benchmark index. The index concluded the week with a gain of 0.89 percent and settled at 40777 levels

On the technical aspect, though, the banking index has maintained its uptrend for the fourth consecutive week, with last two days’ of a profit booking, the weekly chart now depicts a ‘Shooting Star’ Japanese candlestick pattern. Since it has formed exactly at record highs, it would be unfair to overlook it. At this juncture, we are hoping for this pattern to not get activated, so that we can certainly be spared from the real repercussions of it. As far as levels are concerned, 40200 – 40000 are to be considered as key levels. A weekly close below this would certainly damage the recent bullish structure. On the flip side, until we witness a decisive breach above the 41800 zone, a range-bound move could be seen in the comparable period.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One