Broader markets to enhance their relative outperformance - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Broader markets to enhance their relative outperformance

Technical Outlook

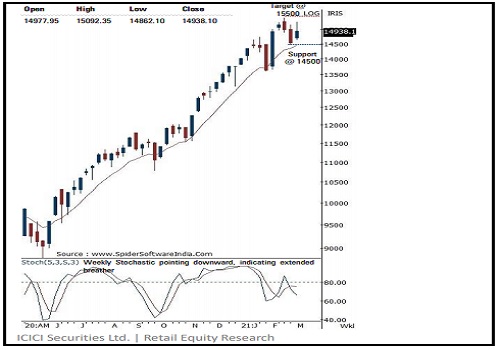

* Equity benchmarks snapped two weeks breather and concluded the week at 14938, up 2.7%. Broader markets endured its relative outperformance as the Nifty midcap and small cap indices climbed ~4%, each during the week. Sectorally, IT, auto and infra outshone while PSU Banks took a breather

* On expected lines, Nifty maintained the rhythm of sustaining above its 50 days EMA since May 2020 and time wise correction not exceeded for more than a week. As a result, weekly price action formed a bull candle carrying higher high-low, indicating pause in corrective bias

* Going ahead, we reiterate our broader positive stance on index and expect Nifty to gradually head towards 15500 in coming weeks. The equity benchmarks exhibited relative strength, as on the smaller degree, intermediate corrections have been shallower and time consuming while rallies have been elongated.

* In the upcoming truncated week, we expect index to undergo healthy higher base formation in the range of 15300-14500 amid stock specific activity. Meanwhile, we expect broader markets to continue with its relative outperformance. Hence, capitalising dips to accumulate quality large caps and midcaps would be the prudent strategy to adopt

* Broader markets clearly shown resilience as Nifty midcap index endured its record setting spree over fifth consecutive week, highlighting elevated buying demand. Meanwhile, small cap index has seen acceleration in catch up activity as currently it is 12% away from its life-time highs compared to February reading of 18%. Thereby, we expect broader market to outperform

* Sectorally, Consumption, Infra, private banks, Pharma , Travel and midcap IT sectors are expected to relatively outperform

* We maintain positive stance on Kotak Bank, Cipla, Berger Paints, EIH, Sagar Cements, Persistent, Birlasoft amid others

* Structurally, the formation of higher peak and trough on the larger degree chart backed by rejuvenation of market breadth makes us confident to retain support base at 14500 as it is confluence of a) Since May 2020, the index has not sustained below its 50 days EMA. Currently, the 50 days EMA is placed at 14505 b) The 50% retracement of February rally (13597-15432), at 14514 c) Last week’s panic low is placed at 14468

* In the coming session, Nifty future is likely to witness gap up opening tracking firm global cues. We expect, index to trade with a positive bias while sustaining above Friday’s low (14862). Hence, use intraday dip towards 15027-15055 to create long position for target of 15139

NSE Nifty Weekly Candlestick Chart

Bank Nifty: 35228

Technical Outlook

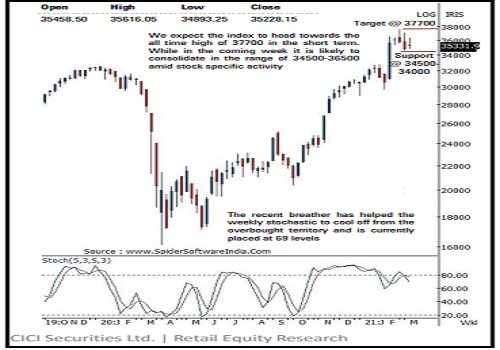

* The Nifty Bank snapped its two weeks decline and closed the week higher by more than 1 % despite sharp decline on the last two sessions of the week on back of weak global cues . The up move was mainly lead by the private banking stocks as Nifty private bank index closed higher by 2 % . The Bank Nifty closed the week at 35228 up by 424 points or 1 . 2 %

* The weekly price action formed a doji candle which remained enclosed inside previous week high -low range signalling consolidation and a pause in corrective bias as index managed to hold intermediate support of 34500 despite rise in global volatility

* In the coming week, we expect the index to continue with its current consolidation in the broad range of 34500 -36500 amid stock specific activity . In the short term the overall structure remain firmly positive and the index is expected to retest its all time high 37700 in the short term

* The index over the past 14 sessions has retraced just 38 . 2 % of preceding 13 sessions sharp up move (29688 -37708), at 34645 . The slower pace of retracement signifies healthy retracement and a higher base formation .

* The recent healthy retracement has helped the index to cool off the overbought conditions of weekly stochastic oscillator (currently at 69 ) and paved the way for the next leg of up move . Therefore, any decline from here on should be capitalised on as incremental buying opportunity as we do not expect the index to breach the revised key support of 34500 - 34000 as it is confluence of the following : a) The 38 . 2 % retracement of the budget rally (29687 -37708 ) placed at 34645 levels b) The last weeks panic low is also placed at 34658 levels

* In the coming session, the index is likely to open on a positive note on the back of strong global cues . volatility would remain high owing to the volatile global cues . We expect the index to trade with positive bias after a gap up opening . Hence use intraday dips towards 35310 -35380 for creating intraday long for the target of 35590 , maintain a stoploss at 35190

Bank Nifty Index – Weekly Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Quote on Bank Nifty : The BANK NIFTY index witnessed a volatile trading session Says Kunal ...