India slips to 56th position globally in y-o-y home price appreciation: Knight Frank

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Below are Views On India slips to 56th position globally in y-o-y home price appreciation: Knight Frank

89% of countries and territories witnessed rise in prices in 2020

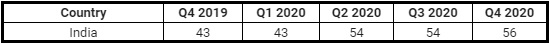

Mumbai, 17th March 2021: Knight Frank, a leading international property consultancy, in its latest research report - Global House Price Index Q4 2020 cited that India has moved down 13 spots in the latest global home price index finish last at 56th rank in the quarter ending December 2020. Against its 43rd rank in Q4 2019, India saw a decline of 3.6% year-on-year (YoY) in home prices, leading to the drop in global position.

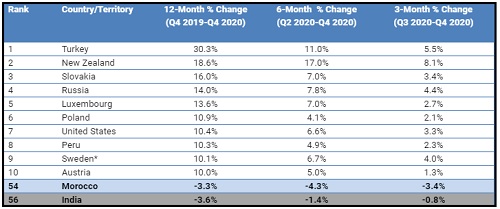

The Global House Price Index tracks the movement in mainstream residential prices across 56 countries and territories worldwide using official statistics. In the 12-month percentage change for the period Q4 2019 – Q4 2020, Turkey continues to lead the annual rankings with prices up by 30.3% YoY, followed by New Zealand at 18.6% YoY and Slovakia at 16.0% YoY. India was the weakest-performing country in Q4 2020, with a decline of 3.6% YoY in home prices, followed by Morocco with a drop of 3.3% YoY.

The report highlighted that 89% of countries and territories saw prices increase in 2020, with several emerging markets performing strongly, including Turkey, which leads the index for the fourth consecutive quarter.

Knight Frank Prime Global House Price Index Q4 2020 Ranked by annual % change

Mainstream residential prices across 56 countries and territories worldwide rose at an annual rate change of 5.6% on average in 2020, compared to 5.3% in 2019. According to the report, markets like New Zealand (19), Russia (14%), the US (10%), Canada and UK (both 9%) have recorded accelerated growth in rankings in the last three months due to a growth in housing demand. In the context of Asia Pacific, the performance remains surprisingly anaemic given its relatively efficient handling of the pandemic. Although New Zealand stood in second place, the region’s next highest ranking is Japan (5%) in 27th place. Hong Kong and Malaysia both saw annual price growth slip into negative territory, and even Singapore’s growth rate was muted at 2.5%.

Indian markets have finished last on the table owing to conditions created by the pandemic. During 2020, the union and state governments have taken many steps to incentives spending and create demand. Steps included historic low home loan rates, reduction in stamp duty and other levies on residential purchases in key markets. Developers have added concessions to the government steps that have amounting to a further reduction in effective prices of homes. These steps have stimulated demand for housing in the latter part of 2020 but have kept prices at bay.

Shishir Baijal, Chairman & Managing Director, Knight Frank India said, “Low-interest rates and other demand stimulation measures by the Government have fuelled real estate demand. This has led to sales and launches in Q4 2020 witnessed a significant jump compared to the first three quarters of 2020. The pandemic has effectively changed end users’ the outlook towards ownership of homes leading many fence sitters to make their purchase decisions. As the vaccine roll out takes place, we expect normality to return, post which the government will have device measures to extend the current sales momentum.”

Key Findings of Global House Price Index Q4 2020:

* India ranked 56th globally in-home price appreciation in Q4 2020

* Turkey leads the index for the fourth consecutive quarter with annual price growth of 30.3%

* Slovakia with 16% YoY jumped from fourth to third place in Q4 2020 report

* Average annual change in price across 56 countries and territories rose to 5.6% in 2020

* New Zealand is APAC’s top-performing country with 19% annual price growth

* Q1 2018 is the last time the index’s annual growth exceeded 5.6%

Above views are of the author and not of the website kindly read disclaimer