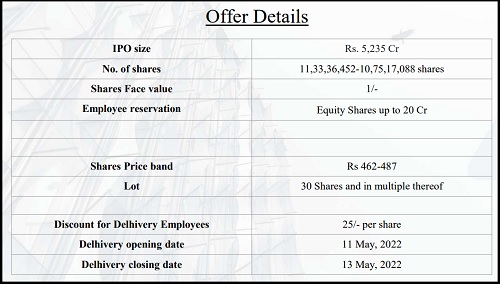

IPO Note - Delhivery Ltd By Jainam Share Consultant

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

About the company

• Delhivery was incorporated as “SSN Logistics Private Limited” on June 22, 2011 and was further renamed as “Delhivery Limited” on October 12, 2021.

• Delhivery was the largest and fastest growing fully-integrated logistics services player in India by revenue as of Fiscal 2021.

• Delhivery’s revenue from operations stood at 36.47 billion rupees.

• By 2021, Delhivery has shipped about more than 1.2 billion parcels with 23,113 active customers.

• Their logistics operating system is at the heart of their integrated solutions. They use about 80 applications which are self-developed and enhanced with data intelligence, to provide various services.

• They have covered over 17,488 pin-codes with about 343 service centers across country.

• They have a market share of approximately 25% of the overall e-commerce parcel volumes in India with a CAGR of 40%.

What is working for the company?

• Rapid growth, extensive scale and improvement in unit economics.

• Advanced proprietary logistics operating system.

• Vast data intelligence capabilities.

• Dense, dynamic, fast and agile network design and engineering.

• Largest and fastest growing fully-integrated logistics services player in India.

• Strong relationships with a diverse customer base.

• Extensive ecosystem of partners, enabling an asset-light business model and extended reach.

• Highly qualified, professional team.

What is not working for the company?

• History of losses and negative cash flows.

• The business is completely dependent on availability of skilled employees (human resources).

• Rely on network partners and other third parties for certain aspects of our business which has additional risks.

• Part of a highly fragmented industry with intense competition.

• Business is subject to various laws and regulations which are constantly evolving

Our Recommendation

• We recommend you to SUBSCRIBE to this IPO on the following parameters:

• One of the objects of the issue is the financing of the project cost towards capacity expansion, technological up gradation, cost optimization of our operations and support to the manufacturing facility and backward integration for manufacturing of hollow pipes.

• The issue seems fairly priced.

• The management team possess good experience in this field.

We recommend you to AVOID to this IPO on the following parameters:

• The company is a loss making startup.

• The issue is very aggressively price.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://jainam.in/

SEBI Registration No.: INZ000198735, Research Analyst: INH000006448, PMS: INP000006785

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer