NRIs Eye Luxury Homes post-COVID, Bengaluru and Pune in Highest Demand By Prashant Thakur, ANAROCK Property Consultants

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Below are Views On NRIs Eye Luxury Homes post-COVID, Bengaluru and Pune in Highest Demand By Prashant Thakur, Director & Head - Research, ANAROCK Property Consultants

* INR 90 lakh – INR 2.5 Cr the preferred budget-range for 73% NRIs post-COVID, against 41% pre-COVID; 3 & 4BHKs in top demand

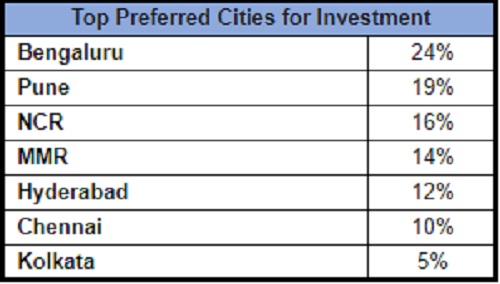

* Bengaluru is the favourite investment destination for 24% of NRI respondents, followed by Pune with a 19% share

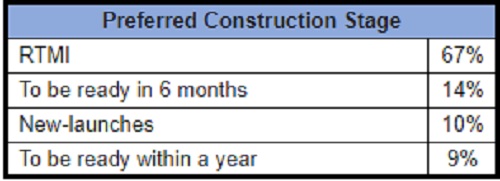

* 67% NRIs looking for ready-to-move-in options

* Of 24% respondents who have booked property in the last six months, 38% were NRIs* 86% NRIs will buy properties from branded developers

In an interesting twist in the post-COVID-19 real estate landscape, NRIs are once again scouting for Indian luxury homes. As per ANAROCK’s latest consumer survey, at least 73% NRIs now prefer properties priced between INR 90 lakh to INR 2.5 Cr. In the pre-COVID survey (H2 2019), just 41% preferred properties within this price bracket - most favoured affordable and mid-segment homes. 3 and 4 BHK options currently top their wish-list.

The IT hubs of Bengaluru (24%) and Pune (19%) are seeing the highest NRI demand. Collectively, these two cities saw approx. 48,370 homes sold in 2020 - accounting for a 35% sales share among the top 7 cities.

Prashant Thakur, Director & Head - Research, ANAROCK Property Consultants says, “The COVID-19 pandemic has increased NRIs' emotional association of long-term security with physical assets. 63% of the polled NRIs state this as their reason for buying homes in India now. They are also driven by the uncertainties posed by COVID-19. Luxury properties have emerged as a hot favourite with NRIs because of the depreciating rupee value translating into greater buying power, coupled with ongoing developer discounts and offers. A majority of NRIs is buying for end-use, not as investments.”

According to the survey, at least 67% of the polled NRIs are looking for ready-to-move-in homes. If we consider the overall survey trends (including NRIs and resident Indians) just 29% preferred to buy RTM homes, with another 27% respondents preferring under-construction properties that will be delivered within a year.

Of the total 24% survey respondents who already booked properties in the last six months, at least 38% were NRIs looking to make the most of the prevailing market conditions in India, including discounts, offers and lowest-best home loan rates.

86% of the polled NRIs will only consider properties by branded developers who have the highest project completion capabilities, resulting in the lowest execution risk. Another reason for this choice is NRIs' desire to buy into projects with international-grade amenities.

According to the survey, most of the polled NRIs seeking property in India are aged between 35-45 years of age. Among all NRI respondents who participated in the survey, close to 68% considered real estate as the best asset class for them at this time.

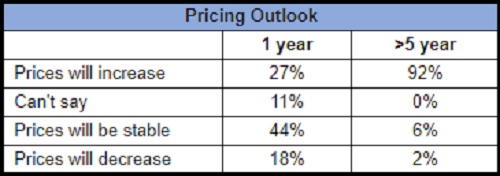

Regarding their outlook on residential property prices, at least 44% respondents felt that prices will remain stable in the short-term (i.e. 12 months), while 27% feel they will increase during the year. Over the long term (i.e. in 5 years), 92% NRI respondents think prices will increase.

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...