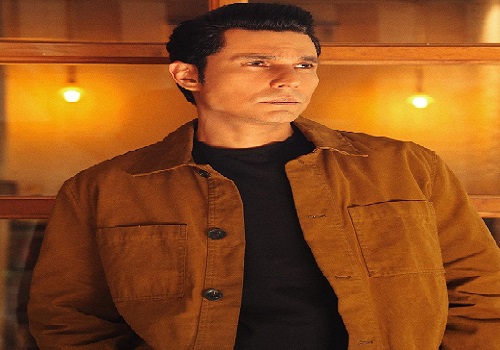

Gradual recovery in business activity, Retail remains the key growth driver By Mr. Dinesh Kumar Khara, Chairman, State Bank of India - Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Below are Views On Gradual recovery in business activity, Retail remains the key growth driver By Mr. Dinesh Kumar Khara, Chairman, State Bank of India - Motilal Oswal

Business activity recovering gradually; impact of the third COVID wave to be controlled

High frequency indicators suggest a broad based revival, and so it expects economic growth to recover gradually. Agri continues to perform well and has been insulated from the COVID-19 pandemic. Retail demand is coming back, while Corporate growth remains subdued as deleveraging is being witnessed across sectors. Unutilized lines of credit remain high across the system (40%/25% for large/mid Corporates for SBIN). Capital formation is picking up, led by investments from PSU entities, while private capex has been low (likely to revert soon). The management sees a much lesser impact of the third COVID wave on economic growth.

Focused Retail lending to be the key growth driver

While the focus is on Retail lending, select pockets/segments are available to grow the Corporate sector as well. Home loan book is growing well, with demand reverting back. The average ticket size of this book is on the lower side (~INR3.5m), with ~50% being towards the Salaried segment. Pre-approved Personal loans are being offered to salaried customers. Asset quality remains robust, with NPAs of less than 0.5%. Despite the sharp uptick in Gold loans, there still remains ample growth opportunities. Auto loans are also seeing a healthy uptick.

The SME segment remains challenging, expects it to recover at a faster pace

The SME segment was highly impacted from the second COVID wave due to cash flow disruptions, and thus witnessed higher restructuring request. It remains a high beta segment, which reverts to normalcy at a faster pace. There have been a change in the behavior of SME borrowers. They are now becoming more financially disciplined. Historically, ~50% of the restructuring used to turn bad. However, the management expects this ratio to fare much lower in the current environment.

Collections improving; RoE to improve to 15% by FY24E

Restrictions on mobility impacted collections over Apr-Jun’21. However, the situation improved post Jul’21, and the bank is witnessing higher collections over Jul-Aug’21. Corporate cleanup is certainly not done and the Balance Sheet is likely to stay insulated, except for any specific market-related risk. The management expects NPAs to remain under control and is looking at NPAs similar to Mar’21 levels. It aspires to achieve a RoE of 15% by FY24, and expects CD ratio to pick up from the current levels of ~65%.

YONO – Strengthening distribution franchise, aiding operational efficiency

YONO has assumed significant importance as a distribution channel while aiding overall operational efficiency of the bank. Around 95% of total transactions are via the alternate/digital route, with the bank having a market share of 27% in remittances. Around 50k accounts are being opened via YONO on a daily basis. YONO disbursed loans worth ~500b in the last three quarters of FY21. Over FY22 YTD, YONO disbursed pre-approved Personal loans of over INR80b (0.4m accounts), Home loans worth INR50b (over 5,000 accounts), Car loans worth INR15b (20k accounts), and Agri and Gold loan sanctions of ~INR130b (0.8m accounts). On the distribution side, YONO sold mutual funds worth ~INR40b, ~8m Non-Life Insurance policies, and 120K Life Insurance policies. The management is not looking to list YONO in the near term.

Other highlights

i) Digitalization of the economy continues at a faster pace, while that of the Banking system is likely to be the key driver of revenue in the future.

ii) Insurance penetration is increasing and has reached closer to the global average. However, the density remains fairly low ~1/10th of the global average

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...