Land tax, fair value, vehicle taxes go up in Kerala, liquor left out

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Presenting his second and the first full budget of the second Pinarayi Vijayan, State Finance Minister K.N.Balagopal on Friday decided to increase the land tax, fair value of land and vehicle taxes, but the biggest relief came for the tipplers as no fresh tax was imposed on liquor.

Balagopal said that it is required to revise the basic land tax which is the central element in land records management.

"The basic land tax would be revised by the introduction of a new slab. The rates would be increased in a calibrated manner in all the slabs. The fair value of land is not in tune with the current market values in many areas of our state. A one-time increase of 10 per cent will be implemented in fair values across all segments. It is expected to result in additional revenue of about Rs 200 crore," said Balagopal.

One-time motor vehicle tax on motor cycles costing up to 2 lakhs is increased by 1 per cent.

Balagopal said that a 'green tax' based on the Central Government's scrapping policy to address the issues of pollution due to old vehicles, is also necessary to discourage the use of diesel vehicles and encourage electric vehicles.

"The green tax imposed on the old vehicles (above 15 years) has been increased by 50 per cent. In addition, Green tax will also be levied on the following categories of diesel vehicles except motor cycles, 3-wheelers, private motor vehicles, medium motor vehicles, heavy motor vehicles and other diesel vehicles," added Balagopal.

With the price of liquor and beer already at the highest level compared to other states, Balagopal has left it untouched, bringing a sigh of relief for the tipplers.

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

More News

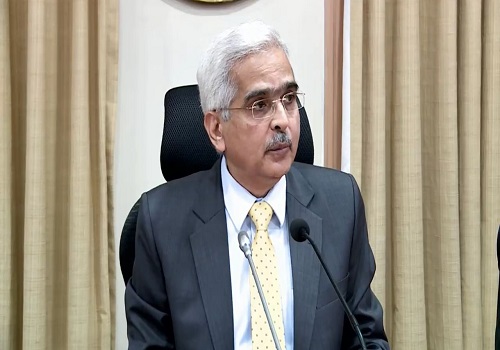

RBI part of G20 Finance Track: Governor Shaktikanta Das