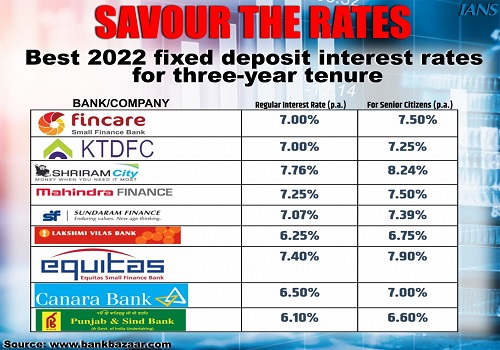

Government hiked deposit rates to tame inflation; baby steps, say experts

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Concerned over rising inflation, the government, aiming to tame price rise, had hiked interest rate for senior citizen savings scheme by 20 basis points from 7.4 per cent to 7.6 per cent on September 30 through a notification.

It had also raised the tenure and interest rate of Kisan Vikas Patra. The interest rate for Kisan Vikas Patra is now 7 per cent for the maturity period of 123 months, compared to the earlier rate of 6.9 per cent for a maturity period of 124 months.

Similarly, after the revision, a three-year time deposit with post offices will now give 5.8 per cent interest compared to 5.5 per cent earlier. For a two-year time deposit, however, the rate hike was only 20 basis points from 5.5 per cent to 5.7 per cent.

Interest rates though were not changed for more popular schemes like Public Provident Fund (where the interest rate is 7.1 per cent), Sukanya Samriddhi Yojana (7.6 per cent), savings deposits (4 per cent) and National Savings Certificate (6.8 per cent).

The rates of one-year and five-year term deposits were also kept unchanged at 5.5 per cent and 6.7 per cent, respectively.

All these hikes came into effect from October 1, 2022 and are valid till December 31, 2022. Experts point out that inflation cannot be controlled unless term deposit rates and rates of small savings schemes are not hiked.

They add, however, that these are baby steps and these rates need to be hiked on a regular basis to bring about a semblance of sanity on rising inflation.

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings