Dollar could see some correction but that may not be a trend reversal - Emkay Wealth Management

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Mumbai, 30 May 2022: As per a report by Emkay Wealth Management titled ‘Navigator’, the US Dollar could see some correction but that may not be a trend reversal. The interest rate outlook for the Dollar remains positive with the US Fed looking to tighten again to slay the demon of inflation.

The pressure on the Rupee continues unabated due to the strength of the dollar, the exit by FIIs from the domestic market, and the worsening of the trade balance. While the RBI may have nothing against a gradual depreciation of the currency, a sudden depreciation amounting to a speculative attack will be contained by the central bank. A revival in macro-economic conditions, a return of the overseas funds, and an improvement in global trade conditions are required for a revival in the fortunes of the Rupee.

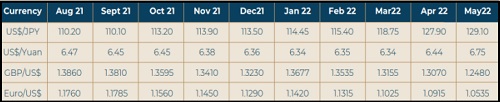

The US Dollar put up a splendid show of strength in the last few months, and it accelerated further in the last three weeks. The Dollar Index moved up to 104.85 earlier in the month, and thereafter, retreated a bit to the 102-103 level. This surge was from the lowest level seen in two months, 100.39 on April 20 22. The big figure has changed in all the majors signifying substantial gains across currencies.

The recent statements from Bank of England on the potential for lower growth and much higher inflation in the UK has created a negative environment because of which Pound Sterling was sold off. The closure of major cities and industrial units in China to prevent the spread of the pandemic has put immense pressure on production, demand and distribution in China. This has weakened the local currency, for the first time in almost a year, the stability in the currency has been lost

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory