Silver - The metal to regain its momentum by Mr. Prathamesh Mallya, Angel Broking Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Below are Quote On Silver - The metal to regain its momentum By Mr. Prathamesh Mallya, AVP- Research, Non-Agri Commodities and Currencies, Angel Broking Ltd

Silver – The metal to regain its momentum

Silver prices in the international markets have had a volatile ride in June 2021 with highs of $28.54 per ounce and lows of $25.52 per ounce, while on the MCX, silver futures traded at highs of Rs.73582/kg and lows of Rs.66628/kg.

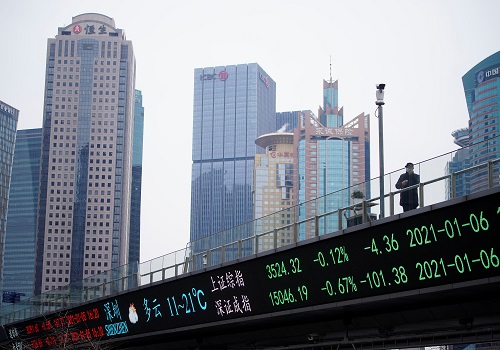

The chart alongside states that silver prices have corrected by around 5.7 percent in the international markets and 4.33 percent on the MCX futures in the time period 1st June to 2nd July Strong recovery in the labour market in the US, strengthening dollar index, rising inflation, led to a bout of profit booking in the recent weeks in Silver prices.

Optimism in the labor market

U.S. companies hired the most workers in 10 months in June, raising wages and offering incentives to entice millions of unemployed Americans sitting at home, in a tentative sign that a labor shortage hanging over the economy was starting to ease. The acceleration in hiring suggested the economy ended the second quarter with strong momentum, following a reopening made possible by vaccinations against COVID-19.

Hedge funds are net longs in silver in the recent weeks

After a good performance in 2020, hedge funds are again betting net longs in silver. The net longs in Silver stood at 33142 contracts as on 29th June 2021, when compared to 23rd March 2021 when net longs stood at 22895 contracts.

The brighter side of the grey metal

Led by industrial use and physical silver investment, global silver demand is projected to achieve a six year high of 1.025 billion ounces in 2021, according to an analysis published by the Silver Institute on February 10,2021. Physical investment, which covers silver bullion coin and bar purchases, is expected to achieve a six-year high in 2021 of 257 million ounces (Moz), as investors continue to add silver to their investment holdings.

Already in 2021, holdings in exchange traded products reached a record level on February 3 of 1.18 billion ounces. Industrial demand is projected to post a four-year high in 2021 of 510 Moz, a 9 percent increase over 2020 figures. Global silver jewelry demand is forecast to rebound to 174 Moz but remain below pre-COVID levels. Silver’s use in the automotive market should also rebound strongly in 2021, to just over 60 Moz, benefiting from the growing electrification of vehicles.

Moreover, Almost 34% of the global silver supply in 2020 was used in electronic devices. And, while this overall segment is expected to continue to grow, one sector in particular – printed and flexible electronics – is forecast to rise a dramatic 54% from 48 million ounces (Moz) in 2021 to 74 Moz in 2030 (Source – The Silver Institute)

What’s in store for silver at present?

The optimism in the labor market in the US, rising oil prices due to the increase in the pent up demand, vaccination pace across the globe are trending factors for volatility in the silver prices. Increasing demand side focus from the automotive sector, increasing COVID infections globally, the liquidity push by the central banks are clear mixtures for silver prices to rise from a month perspective.

The volatility in the metal is the good recipe for traders to take the benefit of the price moves and the momentum suggests that Rs.73000 per kg on the MCX futures (CMP:Rs.70500/kg) looks like a good possibility. In the international markets(CMP:$26.6/oz), $28 looks very much possible from a month perspective. We remain bullish on silver, buy on dips has to be the clear strategy in the grey metal.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Top News

Members of UK Parliament urge Prime Minister Narendra Modi to protect endangered Asian elep...

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One