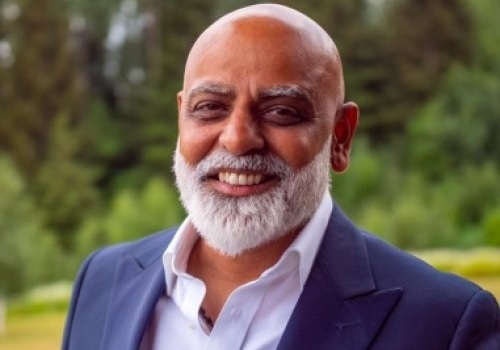

Perspective on Sovereign Gold Bond tranche-7 by Mr. Nish Bhatt, Millwood Kane International

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Below is Perspective on Sovereign Gold Bond Tranche-7 by Mr. Nish Bhatt, Founder & CEO, Millwood Kane International

“The price for the Sovereign Gold Bond tranche-7 has been fixed at 4761/gm. The gold bonds by the government have been a big success, as the government has raised over Rs 32,000 crores since its inception in 2015. SGBs are a superior option to invest in gold without having to worry about its storage cost, making charges in the case of gold jewelry. SGB comes with an advantage due to tax benefits and regular interest payout for the investors. The investment in SGBs has helped the government reduce the deficit, also formalized the investment in Gold in the country.

Gold prices have risen for two consecutive weeks. The rise in the yellow metal price is on account of tapering talks by the Fed. The concerns on how soon will global central banks unwind their liquidity measures. Any step towards liquidity will lead to a rise in interest rates.

The gold prices have strengthened despite a rise in the US bond yield and its impact on the USD. Moving forward gold prices will be guided by the development from the trade talks between the US and China, the new COVID19 variant in China, and its impact on business activities and central banks' action on liquidity and rate hike front.”

Above views are of the author and not of the website kindly read disclaimer