MCX copper prices are expected to move down towards 658 for the day on expectations - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Bullion Outlook

* Comex gold prices declined more than 1.0% on Monday due to stronger dollar and optimistic sentiments in the US markets

* Moreover, concerns over further rate hikes by the US Federal Reserve to cool down the inflation dented demand for precious metals

* However, retreat in US 10 year bond yields restricted further downsides in bullion prices

* MCX gold prices are expected to trade with a negative bias for the day due to firm dollar index. It is likely to get dragged down towards | 51,500 for the day

* Further, silver prices are expected to take cues from gold prices and may move towards | 57,500 levels in coming sessions

* Additionally, investors will remain cautious ahead of series of macroeconomic data from the US

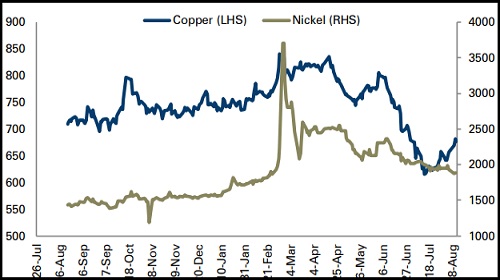

Base Metal Outlook

• LME Copper and other industrial metal prices eased on Monday amid disappointing macro economic data from the China

• China's economy unexpectedly slowed in July, with growth in industrial output, fixed-asset investment, total social financing and new yuan loans slowing

• Additionally, Chinese property developers sharply cut investment in July while new construction starts suffered their biggest fall in nearly a decade

• However, China's central bank unexpectedly cut key interest rates for the second time this year on Monday in an attempt to revive credit demand to support growth

• MCX copper prices are expected to move down towards | 658 for the day on expectations of unsatisfactory housing data from the US

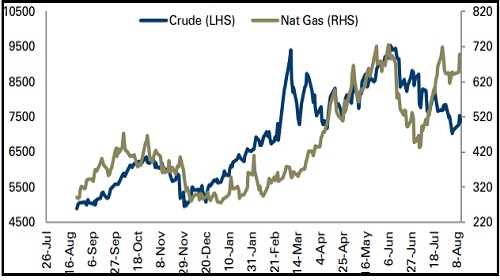

Energy Outlook

• WTI crude oil prices tumbled more than 4.0% on Monday on demand fears as disappointing Chinese economic data renewed global recession concerns

• The China’s refinery output slipped to 12.53 million barrels per day (bpd), its lowest since March 2020, government data showed

• Additionally, talks to revive the 2015 Iran nuclear deal were also in focus on this week. Oil supply could rise if Iran and the United States accept an offer from the European Union, which would remove sanctions on Iranian oil exports

• MCX crude prices are expected to trade with a negative bias for the day on hopes of oil supply resume from Iran and concerns over global fuel demand. It is trading below the mean levels of | 7,580. As long as it sustains below this level, it is likely to correct towards mean -2 sigma levels of | 6,890 in the coming sessions

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer