Gold, Silver, Crude Oil, Natural Gas, Copper, Nickel, Zinc, Lead, Aluminium Commodity Report of 31 March 2021 By Geojit Financial

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

BULLION

GOLD

Prices still have room for further weakness and possibly test lower levels. Even in this bearish note, sturdy trades above 44520 could push prices higher.

SILVER

Broad weakness may persist as long as prices trade below the upside obstacle of 63800 region. But decisive move above the mentioned region may cajole fresh buying in the later session.

ENERGY

CRUDEOIL

A long liquidation move likely to progress if prices stayed below 4480 region. But a direct rise through the above mentioned region could lift prices higher.

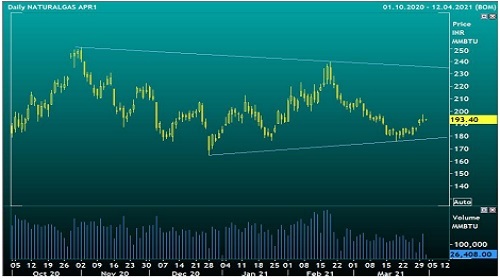

NATURAL GAS

Prices possibly to march higher if prices remained above the Bollinger middle band level of 189.20 region. However, dip below the same may gradually take prices lower.

BASE METALS

Copper

Prices have been consolidating with mild negativity and which possibly to stretch lower in the upcoming session. But rise above 673 could boost prices higher.

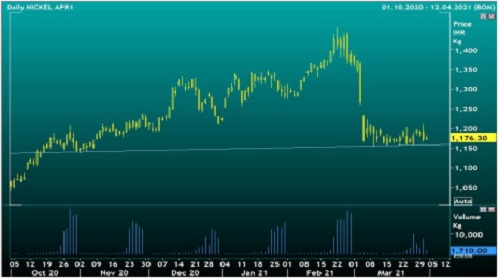

NICKEL

Prices possibly to trade downward trajectory towards the downside objective of 1158 region. In this bearish sentiments determined trades above 1189 could lift prices higher.

BASE METALS

Zinc

Intraday move largely to be southbound if prices remained float below 220.50 region and such emerging weak bias could push prices lower.

Lead

As long as prices stay above the 50-day EMA level of 162.30 could anticipate further price recovery. But a direct fall though the above mentioned region may squeeze down prices lower.

BASE METALS

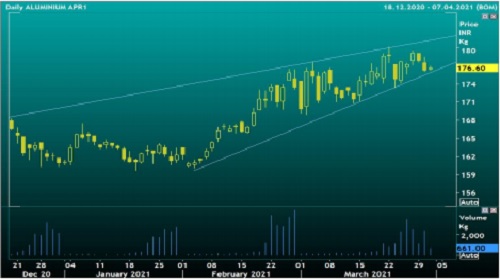

Aluminium

To Read Complete Report & Disclaimer Click Here

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

Exclusive-Zurich Insurance eyes $400 million stake in general insurance arm of India's Kotak

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

Buy Gold Above 49670 Sl Below 49450 TGT 49850/50000 - Axis Securities Ltd