Gold Monthly Outlook By Chirag Mehta, Quantum Mutual Fund

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Below are Views On Gold Monthly Outlook By Chirag Mehta, Sr. Fund Manager-Alternative Investments, Quantum Mutual Fund

Gold struggled to move decisively in either direction with the metal’s price moving in the $1680- 1750/ounce range for most of March, and closing the month close to $1710/ounce with a loss of 1%. A firm US dollar at 4-month highs and rising US Treasury yields which neared 1.8% continued to weigh on non-yielding gold.

Fueled by an accelerating vaccine rollout, fresh round of spending from the Biden administration and US consumer confidence at a 12-month high, markets have priced in a swift turnaround of the US and thus world economy. Risk assets continue to climb, and investors seem to be moving away from diversifiers such as gold in search of higher yielding assets that may benefit from a higher correlation to equity markets.

While some recovery is certain, new waves and variants of Covid-19 continue to take a toll on the pace of the global economic recovery, which is capping gold’s decline. Both Fed Chair Powell and US Treasury Secretary Yellen have shared their optimism about economic growth this year, hurting gold.

Nonetheless, prices are still supported as the Federal Reserve has repeatedly assured markets of no change in its accommodative monetary policy stance any time soon. The US 10-year yield has risen sharply in a matter of two months from 1% in late January to close to 1.75% at the time of writing. But Powell as of now seems unmoved by the recent rally in yields and argued that they were reflecting an improving economic outlook.

Note that the US government is so deep in debt that if yields continue to rise, the Fed would have to step in. Not doing so would mean that interest expenses would grow too much, creating serious problems for the country. In addition, a sustained rise in yields could also hamper consumer and business borrowing and derail the fragile economic recovery, something the Fed would not want. So, the current bearish trend in gold may be short-lived till the market view changes or a policy action is triggered to tame surging yields.

Though higher nominal rates are creating headwinds for gold, part of this will be offset by inflation. For instance, US 10 year real yields moved up by only 8 basis points to -0.63% in March in contrast to the nominal yields which moved up by 29 basis points to 1.74%. Inflation expectations are rising with commodity prices strengthening.

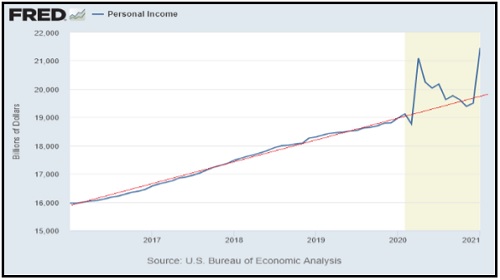

Historically, gold has performed well in high inflation environments. Adding to inflationary concerns, the third round of stimulus checks in the US is set to go out when the income spike from the second round of checks is still pushing personal income up. In contrast, the second round of checks didn't go out until the first round of checks and unemployment benefits

wore off.

Amid these stimulus measures and prospects of a massive infrastructure spend by Biden, inflation worries are justified, which could be the key driver of gold prices going forward. Rising US debt levels as a result of the unprecedented spending and stimulus will keep the dollar under pressure for the next few years, easing pressure on gold. In related news, Yellen hinted that higher taxes could be needed to raise revenues for increased government spending.

Tax hikes in the near future could hurt equity markets and the economy and thus support the price of gold. Despite their recent increase, nominal interest rates remain historically low and real rates across developed markets remain negative. This means non yielding gold is still better off and can perform well. This is also reshaping the traditional 60-40 equity-debt asset allocation in search for yield and because bonds may be less effective as diversifiers during equity market corrections.

This has led some investors to increase strategic allocations to gold. Physical demand in the domestic markets is picking up as investors take advantage of lower prices. But rising infections and resulting restrictions in India could impact demand going forward. Prices may get a push as we step into the upcoming wedding season and with Akshaya Tritiya coming up in May. The Indian rupee which has been appreciating over the last few months is now showing signs of reversal, which could also support domestic gold prices.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Navigating the Markets changing landscape -Quantum Mutual Fund holds Path to Partnership for...

More News

Weekly Oulook : Gold, Silver By Anuj Gupta, IIFL Securities