Cocudakl trading range for the day is 2243-2323 - Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

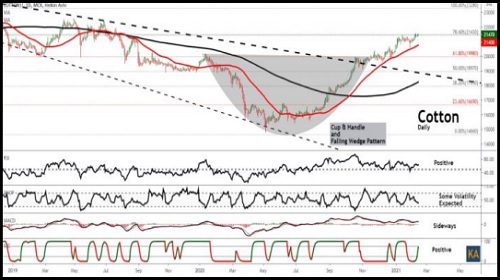

Cotton

Cotton yesterday settled up by 0.19% at 21440 following market expectation of yet another month of lower world cotton stock revision by USDA. Export prospects of Indian cotton has increased once again as domestic prices are a huge discount from overseas cotton prices, which may increase the attractiveness of Indian cotton in the global market. The 2020/21 U.S. cotton supply and demand forecasts show slightly higher exports and lower ending stocks relative to last month. The export forecast is raised 250,000 bales to 15.5 million based on a strong pace of shipments to date. Ending stocks are now estimated at 4.3 million bales, The USDA projects the upland cotton marketing year average price received by producers at 68 cents per pound, unchanged from its January estimate. The 2020/21 world cotton forecasts include higher production, consumption, and imports, led by changes in China. World production is projected 1.3 million bales higher this month, with China’s forecast raised by 1.5 million bales as the daily rates of both ginning and inspections in Xinjiang continue to show late-season strength, which is an unusual price behavior. Reports from China continue to suggest 2020/21 cotton area in Xinjiang was little changed from last year, but government classing data now indicates yields could be about 10 percent higher, while lower in Eastern China. In spot market, Cotton dropped by -50 Rupees to end at 21360 Rupees. Technically market is under short covering as market has witnessed drop in open interest by -13.24% to settled at 4605 while prices up 40 rupees, now Cotton is getting support at 21410 and below same could see a test of 21370 levels, and resistance is now likely to be seen at 21500, a move above could see prices testing 21550

Trading Idea for the day

Cotton trading range for the day is 21370-21550.

Cotton prices ended with gains following market expectation of yet another month of lower world cotton stock revision by USDA.

Export prospects of Indian cotton has increased once again as domestic prices are a huge discount from overseas cotton prices

The 2020/21 U.S. cotton supply and demand forecasts show slightly higher exports and lower ending stocks relative to last month.

Cocudakl

Cocudakl yesterday settled down by -0.35% at 2275 on profit booking after prices seen supported as CAI has kept its consumption estimate for the current crop year at 330.00 lakh bale in the previous month. Last season's consumption was 250 million bales due to disruptions caused by the Covid-19 epidemic. The Cotton Corporation of India (CCI) has sold around 1.28 crore bales (170 kg each) to millers and traders in the 2020-21 season, top officials at the corporation said. According to USDA, India’s production estimate is reduced by 500,000 bales after considering the rising instances of pest infestation, while Pakistan’s production may be 200,000 bales higher and Australia 100,000 bales higher. World consumption is projected 1.5 million bales higher this month, with China’s forecast 1.0 million bales higher reflecting growing domestic textile demand and exports. The latest USDA report has projected world’s cotton mill use in 2020/21 at 117.2 million bales, which is 14 percent above 2019/20.Similarly, China and India together are expected to account for more than 50 percent of the global cotton crop in 2020/21 World’s cotton production is projected at 114.1 million bales, which is 6.5 percent below 2019/20 and the lowest output in 4 years. Meanwhile, global cotton trade is projected to increase, with 2020/21 exports forecast to reach their highest since 2012/13 at 43.9 million bales. In Akola spot market, Cocudakl dropped by -4.95 Rupees to end at 2355.05 Rupees per 100 kgs. Technically market is under fresh selling as market has witnessed gain in open interest by 2.08% to settled at 127880 while prices down -8 rupees, now Cocudakl is getting support at 2259 and below same could see a test of 2243 levels, and resistance is now likely to be seen at 2299, a move above could see prices testing 2323.

Trading Idea for the day

Cocudakl trading range for the day is 2243-2323.

Cocudakl dropped on profit booking after prices seen supported as CAI has kept its consumption estimated at 330.00 lakh bale

According to USDA, India’s production estimate is reduced by 500,000 bales after considering the rising instances of pest infestation

The latest USDA report has projected world’s cotton mill use in 2020/21 at 117.2 million bales, which is 14 percent above 2019/20.

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaime