Sectoral indices – Relative to benchmarks By ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

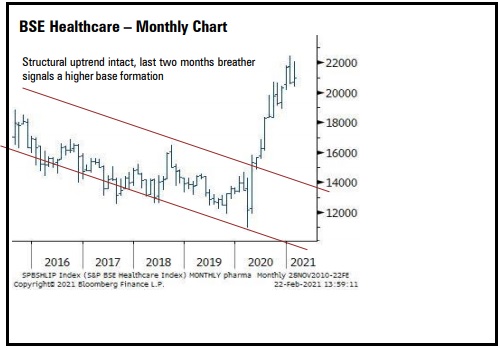

Technical Outlook - Pharma

* The Healthcare index witnessed healthy profit booking in February, after two month rally, which augurs well for larger uptrend

* In relative strength model, primary uptrend on RSC line is intact. We believe current corrective phase is an incremental opportunity to buy quality companies

* Technically, we remain constructive on Ajanta Pharma, Laurus Labs, Sequent and Apollo Hospital while Divis, Sun Pharma and Indoco Remedies provide a favourable riskreward setup

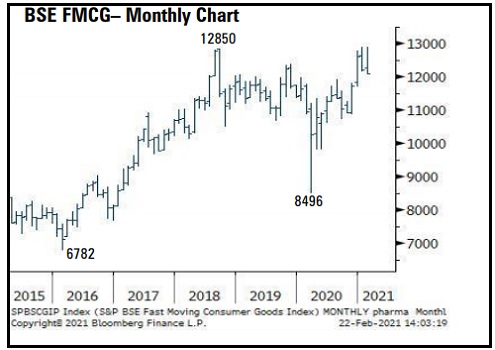

Technical Outlook - Consumption

* The discretionary space witnessed accelerated momentum in February 2021 while some of the staples under performed

* We believe the sector will perform in line with benchmarks in coming months and maintain overall positive stance

* We expect V-Guard, Trent and Astral to outperform while HUL, Titan and Voltas provide a favourable riskreward setup

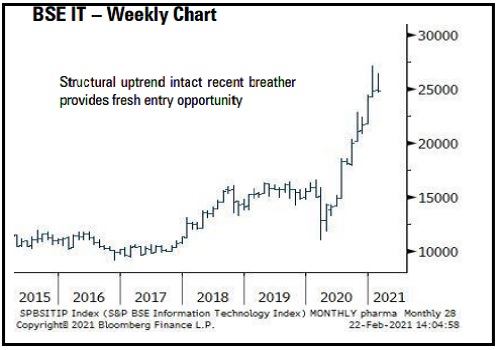

Technical Outlook - IT

* The IT index gained undergoing healthy profit booking in February

* The recent profit booking is part of the retracement of November-December rally and should not be construed negatively rather incremental buying opportunity. RSC line remains in clear up trend indicating relative outperformance ahead

* We remain structurally bullish on TCS, Tata Elxsi, FSL and Sonata Software while Quess Corp and Matrimony provide a favourable risk reward setup

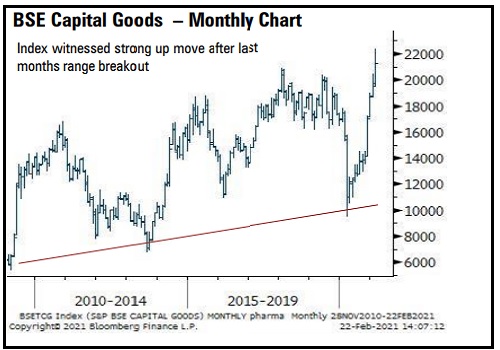

Technical Outlook- Cap goods

* Capital goods sector witnessed revival of sentiment as momentum accelerated after breakout from eight month base formation

* In relative terms, the sector has resumed outperformance after prolonged underperformance. Expect the sector to continue its current up move

* Stocks like L&T, Siemens, SKF and Thermax are likely to outperform while Cummins, Elgi Equipment and Timken provide a favourable risk risk-reward setup

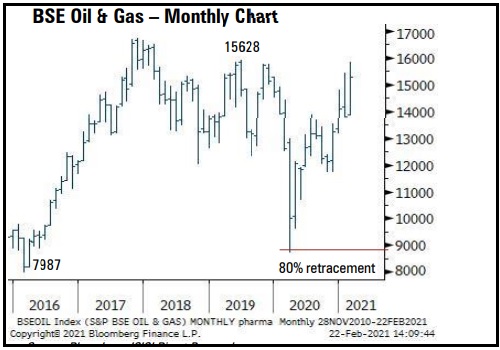

Technical Outlook – Oil & Gas

* The upstream oil companies and OMCs witnessed renewed momentum in February

* In relative terms, the sector is expected to remain underperformer after prior months breakdown, while stock specific activity to continue

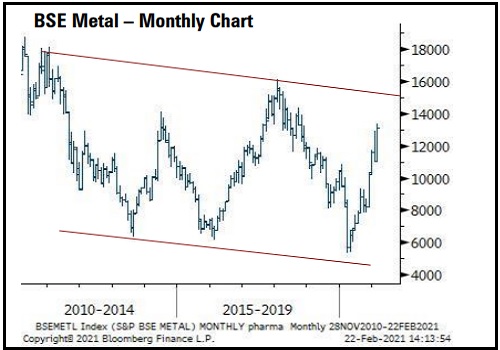

Technical Outlook - Metal

* The metal index outperformed in February led by strong rally in base metals led by copper. The index, in the coming month, is expected to extend its outperformance and strong up trend

* The ratio line is seen rising higher indicating relative outperformance going ahead

* We like Tata Steel, Ratnamani Metals and Hindalco to outperform while MOIL and Vardhman Speciality steel provide favourable risk-reward setup

Technical Outlook - Auto

* The Auto index witnessed strong momentum as index broke past two year highs

* We expect commercial vehicle and tractor space to outperform PV considering robust price structure and favourable risk reward

* Technically we expect Hero MotoCorp, Tata Motors, M&M and Minda industries to outperform while Asahi India, JK Tyres, Mahindra CIE and Wabco offer a favourable risk-reward setup

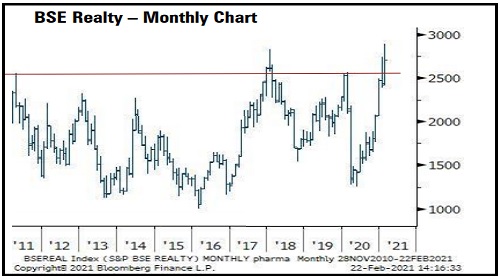

Technical Outlook – Realty & Infra

* The infra sector is poised for multi year breakout led by heavyweights

* In relative terms, the ratio line is headed higher signalling outperformance to continue in coming months

* We believe technically, Brigade PNC Infra, JK Cement and Godrej Properties will outperform while JK Lakshmi provide a favourable risk reward setup

To Read Complete Report & Disclaimer Click Here

For More ICICI Direct Disclaimer https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct