Oil and Gas Sector Update - Petrol cracks boost GRM to 14-month high, but diesel weak By ICICI Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Petrol cracks boost GRM to 14-month high, but diesel weak

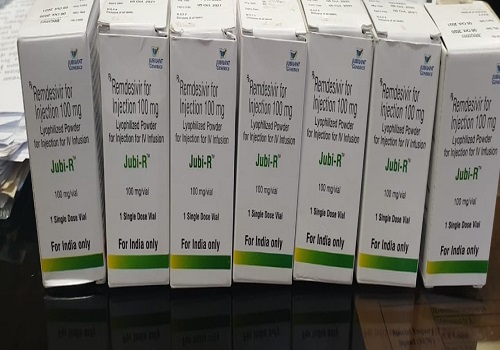

Reuters’ Singapore GRM, though still modest, is at a 14-month high of US$2.4/bbl in Apr’21-TD driven mainly by petrol cracks, which at US$11/bbl are at a 17-month high. US snowstorms that cut utilisation and led to steep inventory fall is the main driver of petrol cracks. Diesel cracks, however, at US$4.6/bbl are well below precovid of US$11.0-14.3/bbl in Q4-Q3FY20.

We estimate Q1FY22-TD core GRMs of BPCL, IOC and RIL at US$1.8-4.1/bbl which, though modest, are among the strongest since covid struck. Diesel cracks appear hit by demand weakness in parts of Europe and rise in refinery yields as jet fuel output is capped. Recovery in diesel cracks is key to GRM rising to our FY22E estimate of US$3.4-7.0/bbl. For OMCs, marketing margin recovery to Rs2.5/l is also key to stock performance.

* Petrol cracks surge drives Singapore GRM to 14-month high:

Reuters’ Singapore GRM, which was at minus US$0.9/bbl in Q1FY21, is at a 14-month high of US$2.4/bbl in Apr’21-TD. Petrol cracks, at US$11/bbl in Apr’21-TD are up US$3.9/bbl QoQ and US$8.6/bbl YoY and at a 17-month high, are the main drivers of GRM rise. Petrol cracks strength appears driven by US snowstorms in mid-Feb’21 that kept US refinery utilisation rates below pre-snowstorm level for five weeks (throughput loss of 82.7m bbls). It led to fall in US inventories by 26.5m bbls to 6.8m bbls below five-year average levels (still 2.4m bbls below) and boosted petrol cracks from US$5.2/bbl in Jan’21 to US$11/bbl in Apr’21-TD. Petrol consumption is above pre-covid level in India and modestly below in the US, which accounts for 35% of global demand.

* Diesel cracks still weak:

Diesel cracks at US$4.6/bbl in Apr’21-TD are well below pre-covid level of US$11.0-14.3/bbl in Q4-Q3FY20. US snowstorms also led to 20.2m bbls fall in US distillate inventories to 6m bbls below five-year average levels. However, diesel cracks rise was more modest and did not sustain. Diesel cracks appear hit by demand weakness due to surge in covid in parts of Europe, e.g. Germany, and rise in refinery yields as jet fuel output is capped. Europe accounted for just 7% of global petrol, but for 23% of global diesel demand in CY19, hence diesel demand weakness in Europe has bigger impact on cracks than on petrol.

* Diesel cracks recovery key to GRM recovery:

We estimate Q1FY22-TD GRMs of BPCL, IOC and RIL at US$1.8-4.1/bbl which, though modest, are among the strongest since covid struck. However, they are lower than our FY22E estimate of US$3.4-7.0/bbl. Recovery in diesel cracks would be key to FY22E GRM rising to our estimates. Recovery in global diesel demand (as vaccines are rolled out globally) and refinery closures are likely to drive recovery in diesel cracks. IEA estimates global diesel demand to be at pre-covid level in CY22E. Global refinery utilisation is estimated at 77.8-79.2% in CY21-CY22E from 37-year low of 72.5% in CY20.

To Read Complete Report & Disclaimer Click Here

For More ICICI Securities Disclaimer https://www.icicisecurities.com/AboutUs.aspx?About=7

Above views are of the author and not of the website kindly read disclaimer