Metals and Mining Sector Update : China trade data: Stung by demand cool-down By ICICI Securities Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

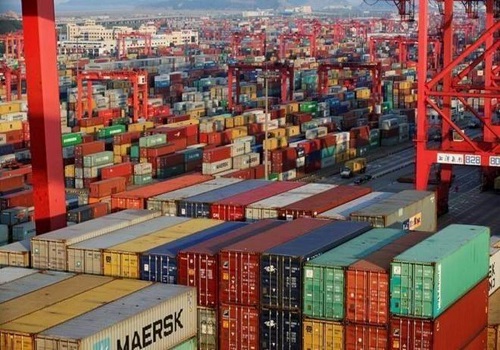

China trade data: Stung by demand cool-down

China’s trade data for Dec’22 reflects the impact of weak global demand (affecting exports) and slowdown in industrial activity due to covid surge post reopening (affecting imports). Key highlights: 1) copper imports, both in refined and concentrate forms, declined 5% MoM and 13% MoM respectively; 2) steel exports fell 3% MoM while aluminium exports rose 4% MoM (but fell 16% YoY); and 3) coal imports fell 4% MoM on subdued industrial activity.

Going ahead, we await the announcement of economic stimulus measures in China post the Chinese New Year (CNY) as the key catalyst for demand uptick. That said, as per Shanghai Metals Market (SMM) estimates, activities at copper and aluminium plants might not pick up immediately post CNY. This would impact trade in both these commodities. As a result, we remain circumspect on the ferrous space with JSPL (TP: Rs750) and Shyam Metalics (TP: Rs425) as our top picks. We however see declining aluminium exports from China as a positive for Hindalco, our top pick in non-ferrous space with a TP of Rs515.

* Trade data hit by two roadblocks: China’s trade data for Dec’22 reflects the impact of both external and internal factors. On one hand, exports were impacted by weak global demand and on the other, imports were affected by industrial slowdown pursuant to covid surge post reopening. Key points: 1) refined copper imports slid 13% YoY (5% MoM) to 514kte due to weak demand as factory activity shrank at a sharper pace amid surging covid and adverse SHFE-LME price arbitrage; 2) copper concentrate imports declined 13% MoM (rose 2% YoY) to 2.1mt as cathode output was 2% lower than expected; this was due to four smelters undertaking maintenance activities and slower than anticipated ramp-up of two newly commissioned smelters; 3) steel exports slid 3% MoM to 5.4mnte as global demand remained weak in Dec’22; and 4) iron ore imports fell 8% MoM to 91mnte (lowest since Jul’22) owing to frequent weather-related disruptions in Australia and Brazil and crude steel production curbs due to lower steel prices.

* Trade data for Jan’23 likely to remain largely muted: We expect trade data for Jan’23 to be impacted by the week-long CNY holiday. Key points: 1) operating rates at most copper smelters is likely to drop slightly compared to Dec’22; however, output is likely to gradually normalise as the newly-commissioned smelters continue to ramp up and the smelters that undertook maintenance gradually resume operations. As per SMM, China’s copper cathode output is estimated at 895kte in Jan’23, up 2.87% MoM and 9.7% YoY, based on the current production schedules; 2) in the case of aluminium, output is likely to be impacted by power shortage in south-west China (Guizhou province). Besides, resumption of production in Sichuan and Guangxi has slowed down due to the power shortage and low profits. Hence, aluminium output is expected to rise by a mere 3.7% YoY to 3.32mnte; 3) in the case of iron ore, the recent rally is expected to reduce the buying interest notwithstanding inventory at ports remaining at a comfortable level of 134mnte. However, in the case of coal, we might see an uptick led by resumption of imports from Australia.

* Outlook – Stimulus is the key: China’s trade data for Dec’22 was muted due to resurgence of covid and muted global demand. Going ahead, we would keep a close tab on stimulus measures post CNY as it is the driving factor for industrial activity, particularly in copper imports. We retain our cautious outlook on the ferrous space with JSPL and Shyam Metalics as our top picks. Among non-ferrous players, we see Hindalco benefiting from potentially lower aluminium exports from China.

To Read Complete Report & Disclaimer Click Here

For More ICICI Securities Disclaimer https://www.icicisecurities.com/AboutUs.aspx?About=7

SEBI Registration Number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

More News

Auto Sector Update - PLI scheme for Auto focuses on advanced technology By Motilal Oswal