No Record Found

Latest News

Agri Commodity Technical Report 19 April 2024 - Geoj...

MCX Crude oil is likely to rise back towards 7250 le...

Commodity Intraday Technical Outlook 19 April 2024 -...

Agilitas Sports acquires exclusive rights for Lotto ...

The Indian rupee is expected to open with a cut amid...

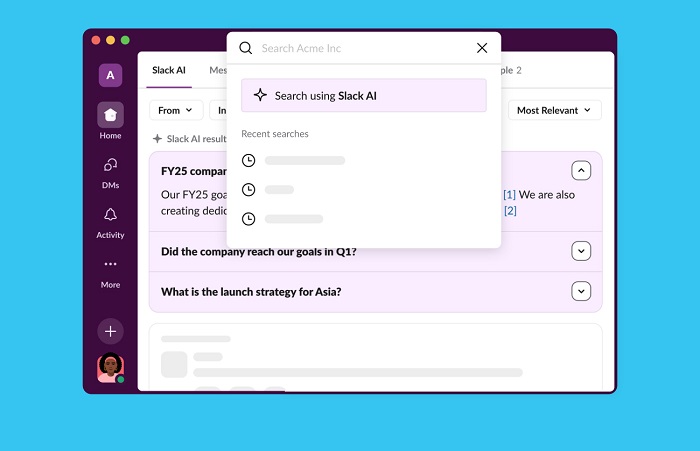

Salesforce rolls out 'Slack AI' to all paid customer...

Buy JPYINR Apr @ 54 SL 53.8 TGT 54.2-54.4 - Kedia Ad...

MCX Gold is likely to trade with positive bias durin...

Volumes of domestic mining, construction equipment l...

Rupee is likely to depreciate today due to strong do...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found