No Record Found

Latest News

Rupee is likely to depreciate today due to strong do...

Vesuvius India shines on inaugurating Mould Flux man...

Buy Turmeric Jun @ 18200 SL 17800 TGT 18600-18900. N...

Indus Towers surges on inking MoU with NTPC Green En...

Just Dial trades higher on the BSE

Nifty witnessed high volatility on Thursday and clos...

ITC rises as its arm inks pact to acquire 100% stake...

Buy Natural Gas Apr @ 145 SL 141 TGT 150-154. MCX - ...

The Index began the session with a gap down action a...

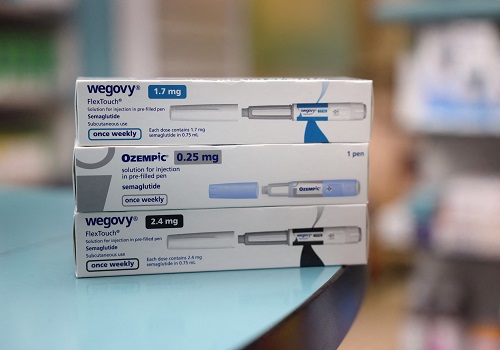

India's Biocon developing its own version of Wegovy,...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found