No Record Found

Latest News

Just Dial trades higher on the BSE

Nifty witnessed high volatility on Thursday and clos...

ITC rises as its arm inks pact to acquire 100% stake...

Buy Natural Gas Apr @ 145 SL 141 TGT 150-154. MCX - ...

The Index began the session with a gap down action a...

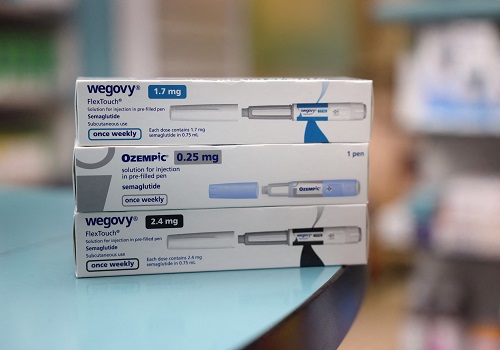

India's Biocon developing its own version of Wegovy,...

Tata plans Jaguar Land Rover EV imports to India und...

The index witnessed a perfect pullback within the on...

India says it is ready to mitigate economic impact o...

India VIX closed with 3.37% gain at 13.04 level - Mo...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found