No Record Found

Latest News

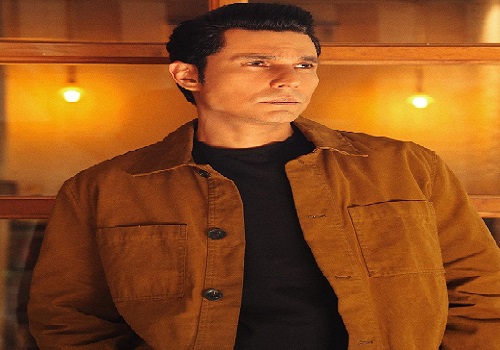

Randeep Hooda opens up on next directorial: Maybe I ...

Olympic Selection Trials: Ashi Chouksey , Swapnil ta...

Indian chess body AICF exploring possibilities of ho...

FIIs stood as net sellers in equities as per April 2...

Internet subscribers reach 936.16 million in India, ...

Post-market comment by Mandar Bhojane, Choice Broking

Daily Market Analysis : Markets edged higher for the...

54 pc Indian workers predict key shift in their role...

Domestic demand improved on a sequential basis in Ma...

IPO Note : JNK India Ltd by Geojit Financial Service...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found