No Record Found

Latest News

Olympic-bound Preeti to spearhead India`s 50-member ...

Former wrestler Narsingh elected chairman of WFI`s a...

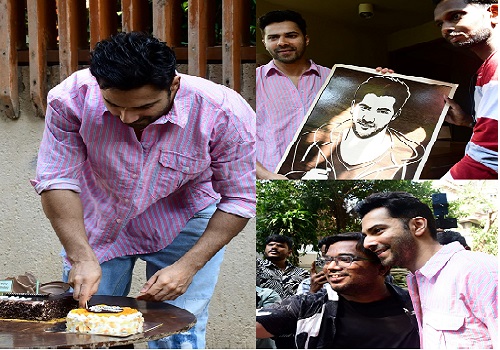

Varun Dhawan celebrates his 37th birthday at home wi...

Ashish Vidyarthi promises untold stories from Pulwam...

REC okays Rs 1,869 crore loan for Kiru hydro project...

India`s LTIMindtree`s Q4 revenue misses estimates a...

Madhya Pradesh: `Jalabhishek`performed at Ujjain`s M...

Drone war competition organised in Jammu, propelling...

Evening Roundup : A Daily Report on Bullion Energy &...

CriticalRiver Sets Stage to Become 100% Employee-Own...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found