5 income tax changes announced in Budget 2019

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Now Get InvestmentGuruIndia.com news on WhatsApp. Click Here To Know More

Finance Minister Piyush Goyal in Budget 2019 proposed many changes in income tax rules for the year 2019-20. Besides higher standard deduction, he also proposed no tax on income up to ₹5 lakh. At present, income up to ₹2.5 lakh is exempt from personal income tax. Income between ₹2.5 and ₹5 lakh attracts 5% tax, while that between ₹5 lakh and ₹10 lakh is taxed at 20%. Income above ₹10 lakh is taxed at 30%.

Budget 2019: Here are 5 changes proposed on the personal tax front

1) The rebate under Section 87A of the Income tax Act, 1961, has been raised to ₹12,500. It is only applicable for those with net taxable income of up to ₹5 lakh. A rebate is the amount of tax the taxpayer is not liable to pay. So in the next fiscal year, if an assessee has a net taxable income of up to ₹5 lakh, he/she is allowed to claim the entire tax payable as tax rebate. For instance, if an assessee has a gross income of ₹6.5 lakh for the financial year 2019-20, and makes an investment of ₹1.5 lakh under Section 80C, his/her net taxable income comes down to ₹5 lakh, on which his/her tax liability will be ₹12,500 (5% of ₹2.5 lakh), excluding cess (income up to ₹2.5 lakh is exempt from tax). Against this, a rebate of ₹12,500 will be available and, thereby, the net tax will come down to zero.

Budget 2019 LIVE updates: Catch all the updates

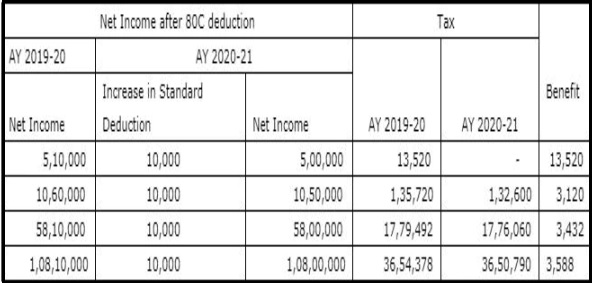

2) Standard deduction increased from ₹40,000 to ₹50000. A standard deduction reduces your taxable income, thereby reducing your tax liability. Standard deduction was re-introduced last year. This increase of ₹10,000 in standard deduction will result in tax savings of ₹3,000 for individuals in the 30% tax bracket (excluding surcharge and cess).

“The benefit of enhanced tax exemption of up to ₹5 lakh has been provided in the form of a rebate and will only benefit resident taxpayers having total income up to ₹5 lakh. Other taxpayers in higher income slabs will have to settle with a meagre increase of ₹10,000 in standard deduction," Hitesh Sawhney of PwC said.

3) In the Budget, the finance minister proposed exemption from notional rent in respect of two self-occupied house properties. Currently, if a person has two properties which are self-occupied, deemed rent from one of the house properties is taxable.

Budget 2019 highlights: All you need to know

4) The finance minister also proposed to extend the one-time benefit of capital gains exemption on reinvestment in two house properties. This benefit will apply where capital gains are ₹2 crore or less. Currently, the exemption is applicable only against one house property.

Commenting on the budget proposals, Nitin Baijal, director at Deloitte, said: “A good relief for the lower income group earning income in the range of ₹6.5-7 lakh (before 80C and 80D benefits). The government has particularly focused on providing tax sops in the real estate sector covering benefit both under the head house property and capital gains. It has also realised the growing needs of urban families wherein people moving to different cities for jobs or business need to support their families in the home city."

5) The threshold on TDS on interest from bank or post office deposits has been increased to ₹40,000, from current limit of ₹10,000. This means interest income on bank/post office deposits up to ₹40,000 will not be subject to TDS.