No Record Found

Latest News

Spices Board Takes Action in Response to Recall of I...

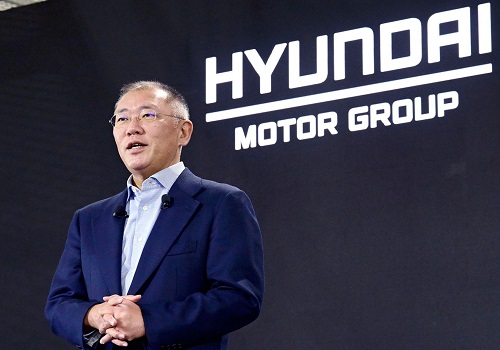

Will make India our global export hub: Hyundai Motor...

Mid-market comment by Mr Shrey Jain, Founder and CEO...

India`s Axis Bank re-appoints Amitabh Chaudhry as MD...

Former KPMG Partner, Jaideep Ghosh, joins Heartnet I...

Buy Jeera May @ 22500 SL 22200 TGT 23100-23400. NCDE...

Axis Bank shines on turning black in Q4

RBI crackdown triggers crash in Kotak Bank shares

Buy Naural Gas May @ 165 SL 162 TGT 169-171. MCX - K...

Delivers Industry leading Volume Growth of 18.5%YoY ...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found